Japan’s stock markets are soaring.

The Nikkei is hitting levels it has not visited in decades. The surge of money is both a vote of confidence in Japan’s prospects as well as a reflection of concern about China’s future and other investor options. Japan’s stocks are likely undervalued compared to many alternatives, but what is most important is creating economic and investment incentives that stimulate long-term balanced growth rather than short-term opportunities.

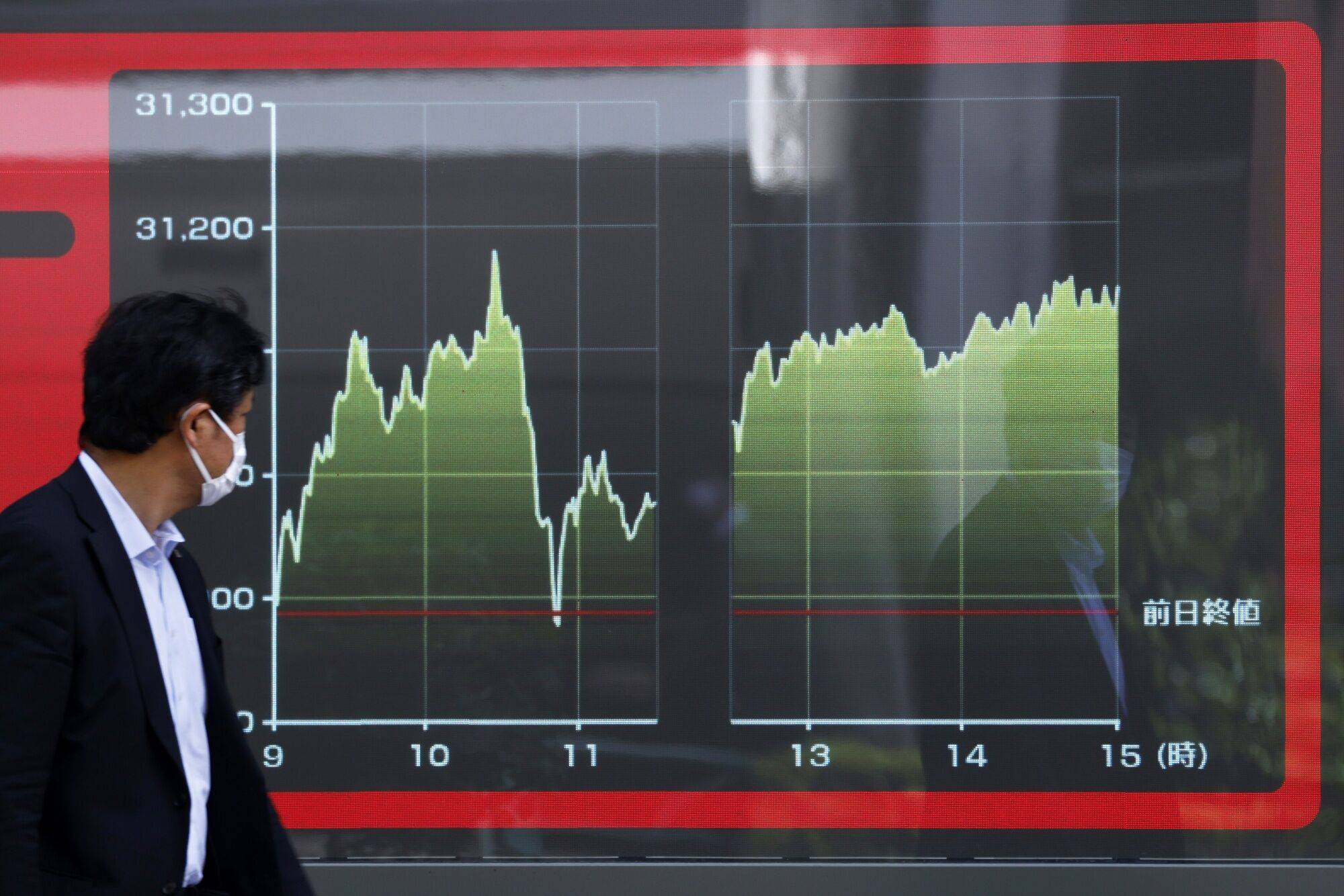

Money is pouring into the country with the stock market value increasing about $518 billion since early January. In May, the Nikkei 225 had its best month in over two years and stocks closed at one point at their highest level in 33 years. The index outperformed all major global stock indexes last month, posting a 7% gain, and has risen 18% this year, making it Asia's best performing stock market. It’s 88% above its low in March 2020. The Topix Index, which tracks all stocks on the market rather than just the top 225, has also posted a double-digit gain in 2023.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.