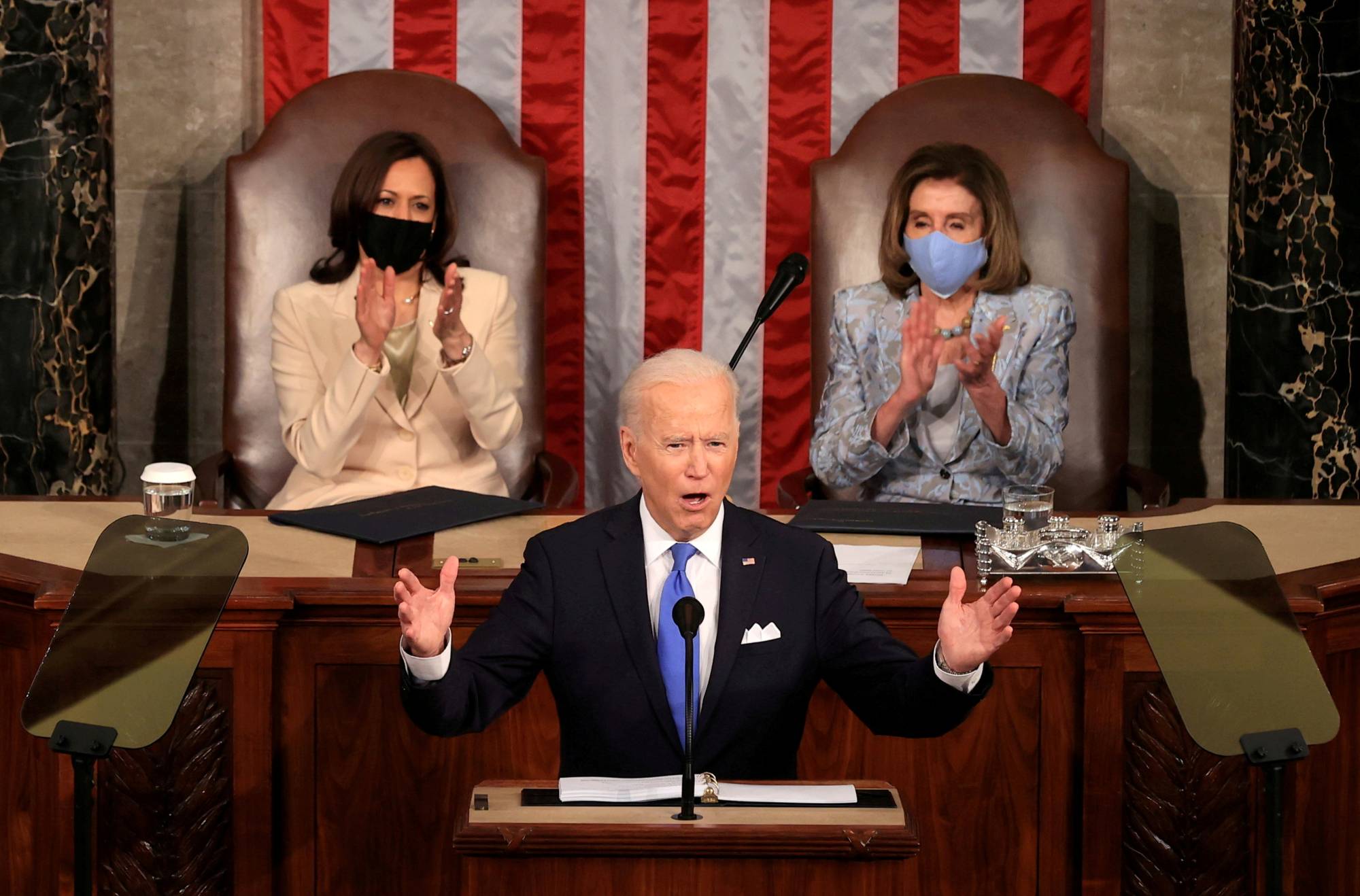

U.S. President Joe Biden’s spending plans have been grabbing headlines, and rightly so. The administration’s relief package and infrastructure plan could remake the U.S. welfare state by bolstering the social safety net and increasing spending on transportation, broadband, and education.

But with U.S. government spending likely to remain high after the COVID-19 pandemic, tax revenues must increase, because additional borrowing can finance only so much. Hence, the Biden administration has proposed the equally sweeping Made in America Tax Plan, which would increase corporations’ share of tax revenues.

Raising the corporate tax rate is the best option. In the first decade after World War II, taxes on individual incomes and social insurance receipts made up about 50% of federal tax revenues, while corporate taxes accounted for another 30%. But since then, the former category has increased steadily, reaching about 85% of total federal tax revenues, while the corporate share has fallen below 10%.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.