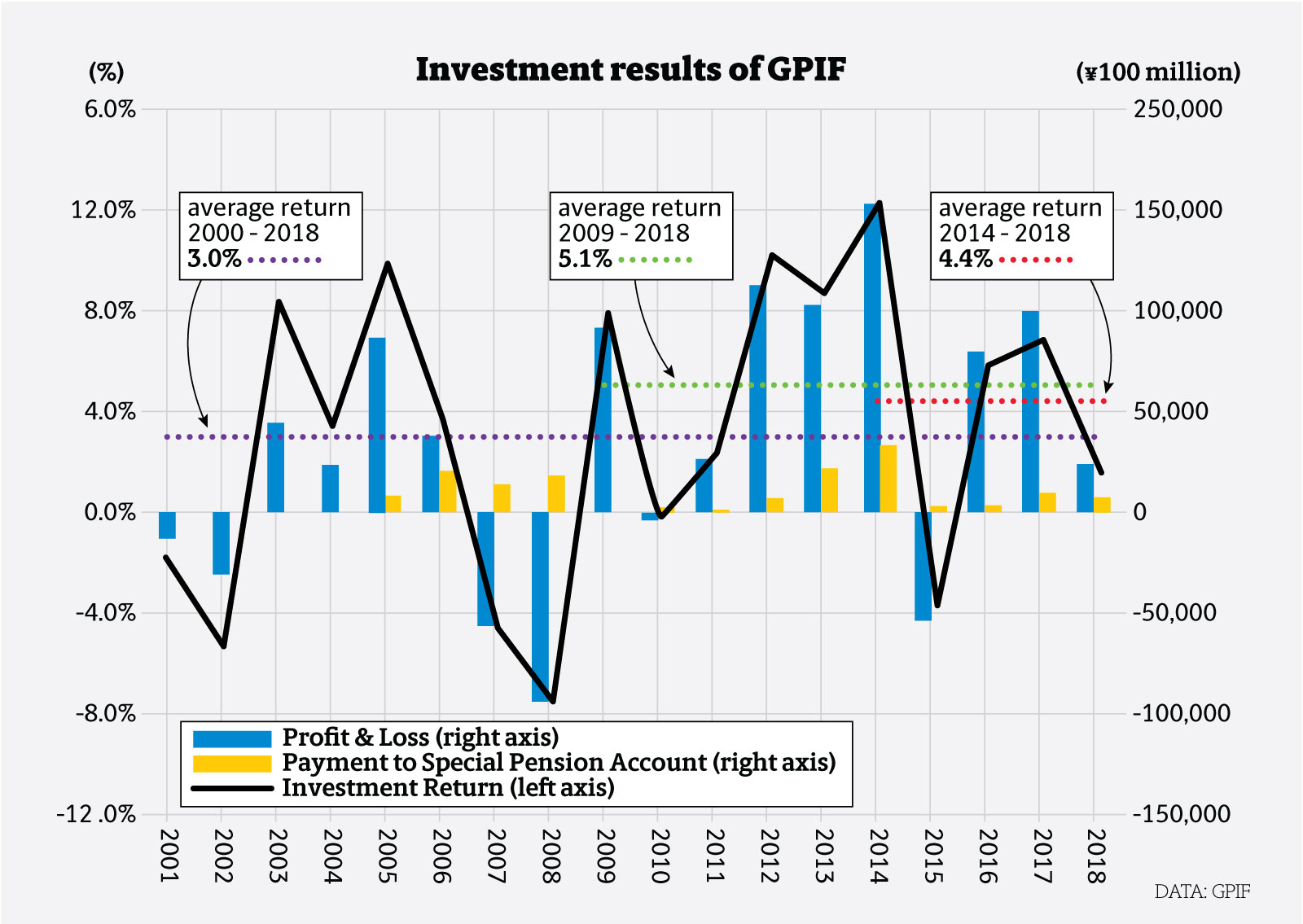

The Government Pension Investment Fund earned ¥2.4 trillion through management of its reserve fund in fiscal 2018 for a rate of return of 1.5 percent, according to its report released in early July. It suffered an appraisal loss of ¥14.8 trillion in the October-December period due to sharp falls in Japanese and overseas stock markets, but the GPIF's whole-year earnings became positive thanks to the recovery in share prices in the January-March quarter, which brought ¥9.1 trillion in earnings.

As it has long been pointed out, arguing over performance of the public pension fund over a short cycle like a quarter or a year is extremely inappropriate since they are supposed to be managed over a very long term.

Some members of the opposition camp have criticized the administration of Prime Minister Shinzo Abe for exposing the public pension reserve — the assets of the people — to danger by reducing the share of Japanese government bonds while increasing that of Japanese and foreign shares as well as foreign bonds in the asset allocation of the GPIF.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.