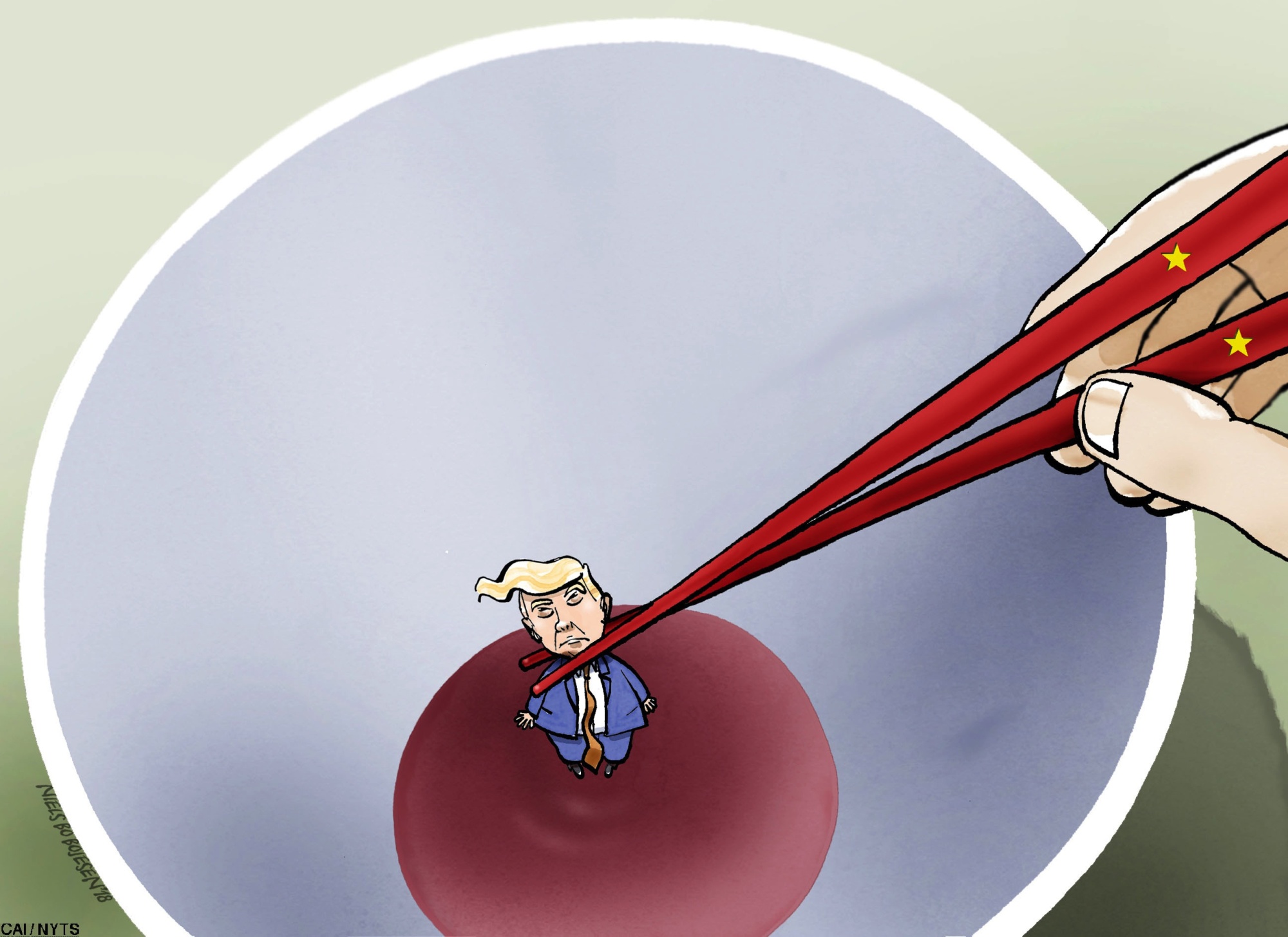

Markets are quivering as fears of a U.S.-China trade war ebb and flow. Thus far, they've mostly been focused on tariffs that U.S. President Donald Trump wants to impose on a range of Chinese goods, and China's threats to retaliate. But investors may be overlooking a bigger risk in this dispute.

It's true that duties on U.S. imports would hurt — hands are already wringing in farm country — but there's a limit to how much pain they can really inflict. The persistent worry that China will dump its mammoth holdings of Treasury bills is probably unfounded as well.

The risks for U.S. firms already operating in China, however, could be significant. Here Beijing can stab at the soft underbelly of a wide range of American companies, from Apple Inc. to General Motors Co. to Starbucks Corp. Although these companies have well-established brands, sizable businesses, and strong connections to Chinese consumers, they could still face serious harm if Beijing wants to turn up the heat on Trump.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.