The record of economists, including those at the Federal Reserve, over the past half century has been discouraging. The two greatest blunders are well-known: policies that fed double-digit inflation in the 1970s, reaching a peak of 13.5 percent in 1980; and the more recent failure to prevent the 2008-09 financial crisis and Great Recession, sending unemployment to 10 percent.

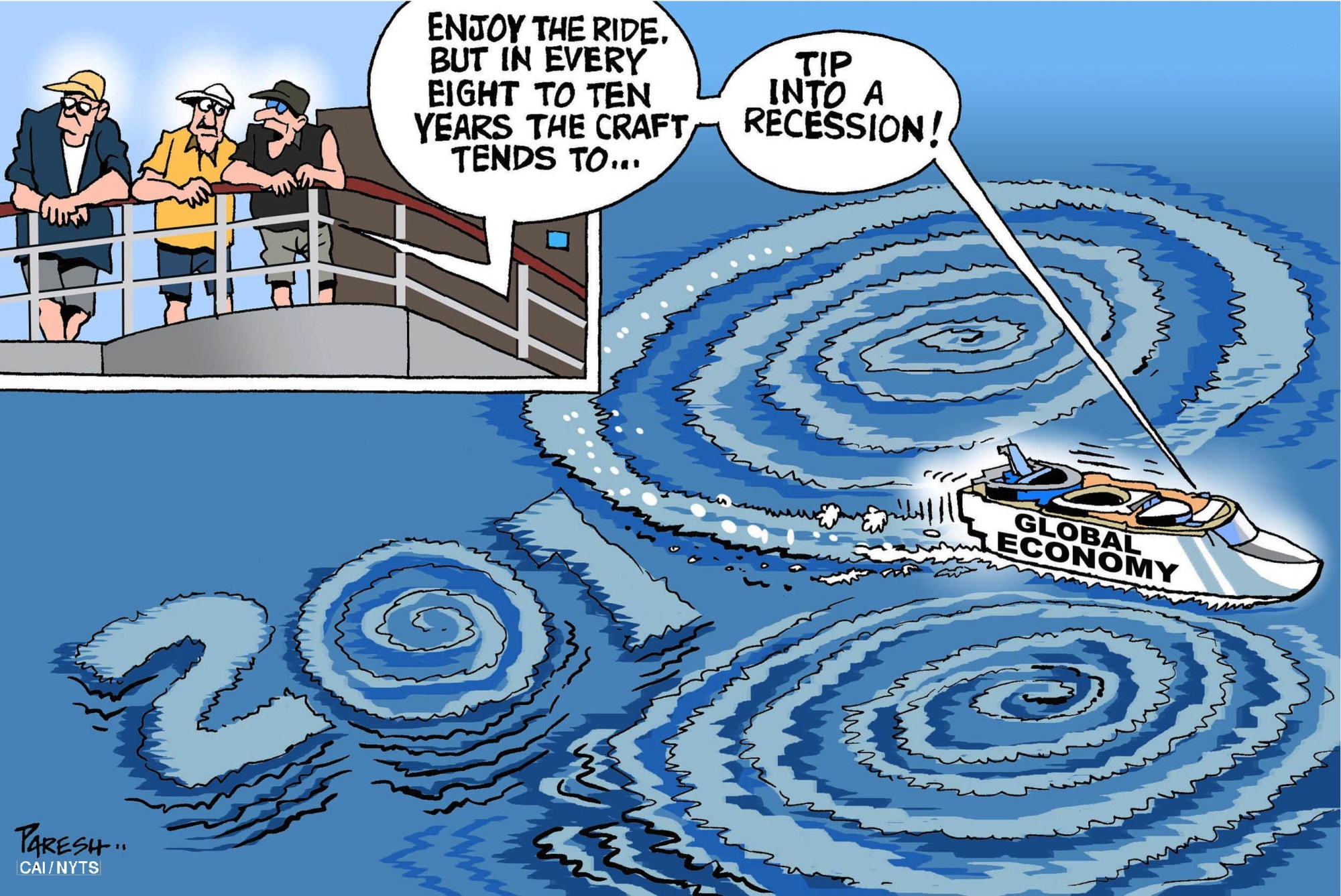

Unfortunately, there are many other lapses. Economists generally have been unable to predict the onset of recessions. Since at least the 1970s, they have routinely missed turning points in productivity, for better or worse ("productivity" is economist-jargon for "efficiency"). More recently, they've been surprised by the plunge in long-term interest rates and by a lengthy stretch of low inflation.

The dirty secret of economics is how much economists don't know. Their ignorance is increasingly relevant, because there is growing agitation among economists to stage a grand debate over the role of monetary policy — how the Fed influences interest rates, credit conditions and the money supply.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.