Excessive debt is becoming a double-edged sword for Shinzo Abe's Japan. For all the prime minister's talk of fiscal consolidation and tax hikes to pay down debt, Tokyo keeps smashing records. The latest: national IOUs hit ¥1,080,441 billion in September, increasing by the equivalent of Nicaragua's annual output in just three months.

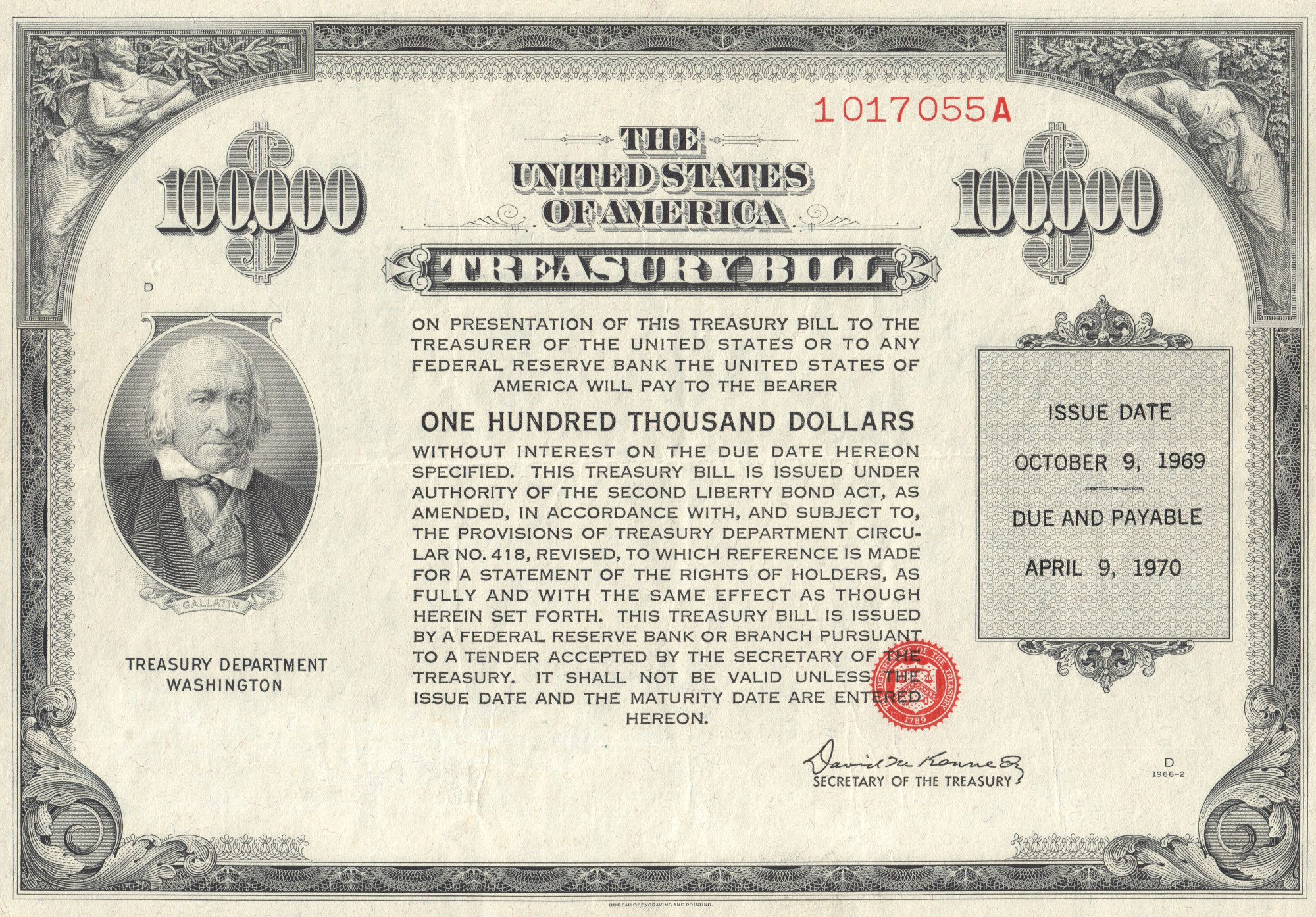

But the debt that should worry Abe's team the most over the next few months is Tokyo's $1.1 trillion of U.S. Treasuries.

Even the International Monetary Fund recently threw shade at tax cuts for the wealthy — like U.S. President Donald Trump's. It argued they're not worth the fiscal fallout — rising bond yields and weakened creditworthiness — if middle-class households don't enjoy most of the benefits. Republicans are pushing ahead anyway, leaving the Bank of Japan and Finance Ministry with the fallout — and a dicey geopolitical dilemma.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.