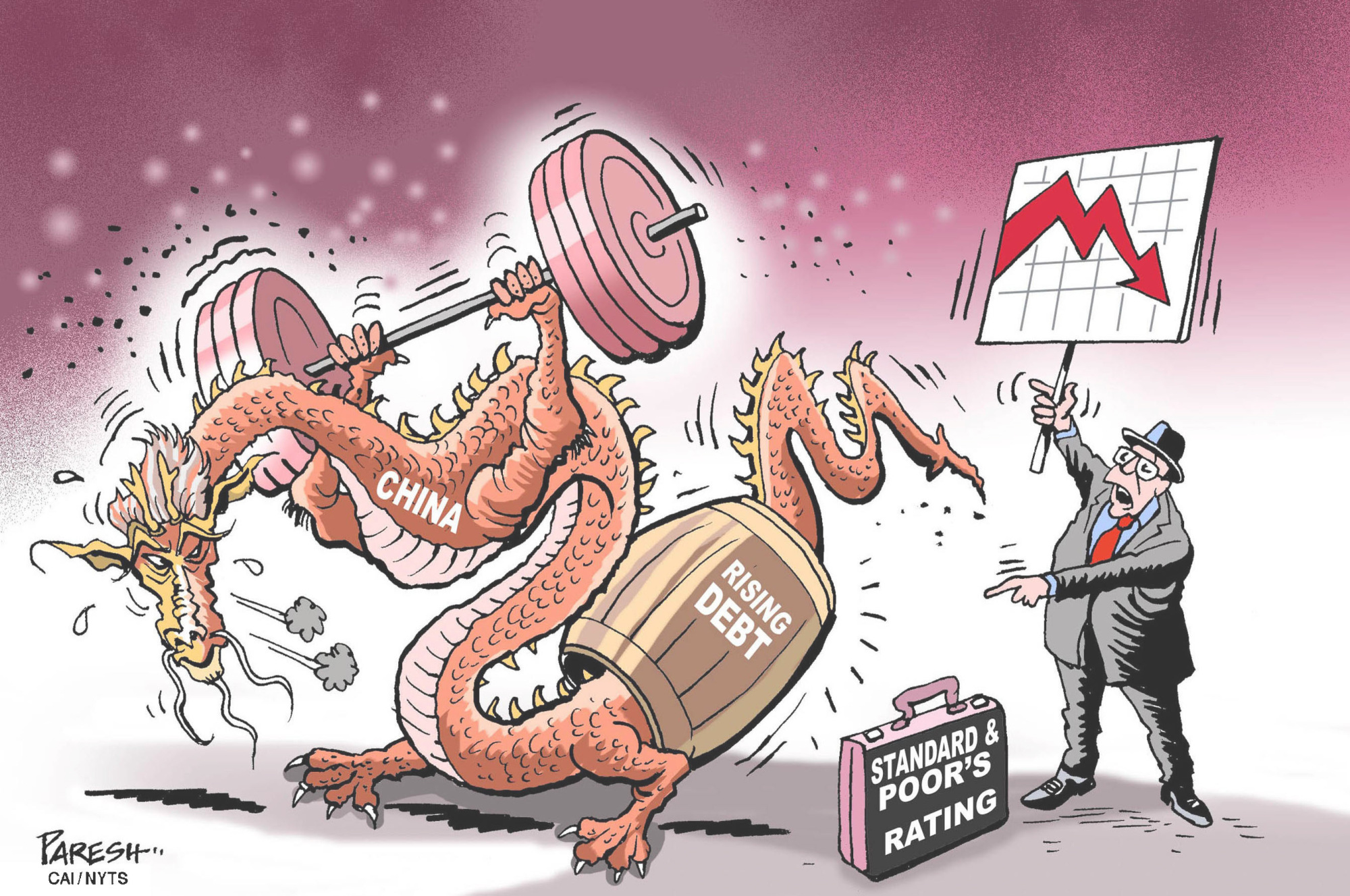

For all the mystery surrounding who will rise and fall at next week's big leadership conclave in China, only one question really matters to investors: Will President Xi Jinping, having sidelined any obvious opposition, attack head-on the enormous imbalances and risks building inside the Chinese economy?

Optimists argue that he will. The Economist Intelligence Unit recently wrote, "Xi will find his ability to implement policy substantially reinforced by newly strengthened majorities. After the Party congress, we believe that Mr. Xi will have even more room to pursue a deleveraging agenda." By this logic, Xi recognizes that the explosion of debt in China following the global financial crisis in 2008 poses an almost existential threat and has only been waiting to clear away internal resistance before moving boldly to address it. Having now amassed all the levers of power necessary to ensure success, he is sure to prioritize economic and financial reform.

This logic is curious, however. It implies that Xi — already the most powerful Chinese leader since Deng Xiaoping and a man who has swept away thousands of corrupt cadres, imposed far-reaching reforms on the People's Liberation Army and tightened the Communist Party's control over virtually all information in China — has simultaneously been powerless to execute basic economic reforms. The European Chamber of Commerce in Beijing summed up the doubts of many recently when they complained of "promise fatigue." It seems unlikely that a few changes in the senior Politburo will suddenly unleash capabilities that Xi didn't possess previously.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.