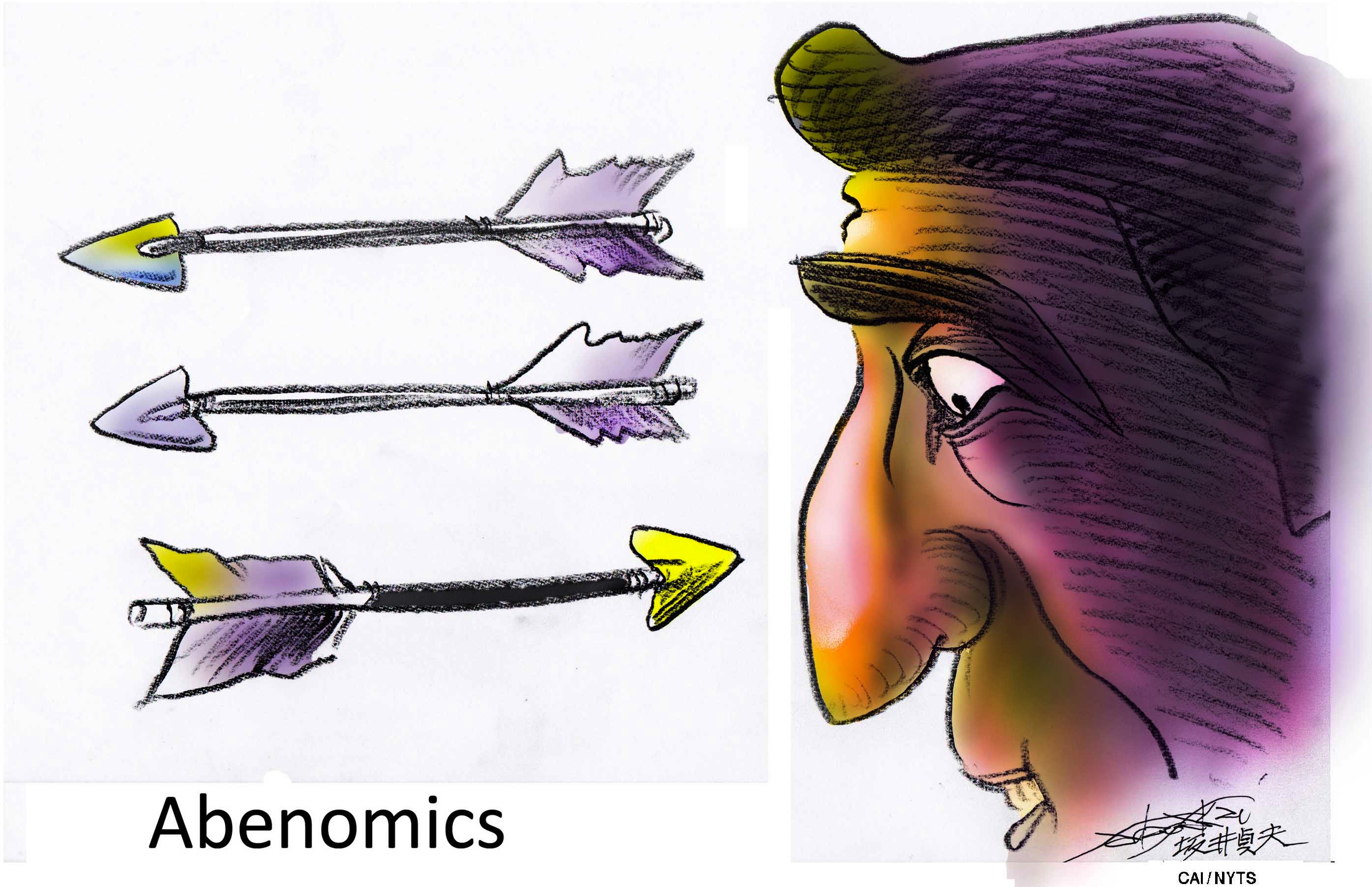

Financial markets were surprised by the Bank of Japan's recent introduction of negative interest rates on some commercial bank reserves. They shouldn't have been. The BOJ clearly needed to take some new policy action to achieve its target of 2 percent inflation. But neither negative interest rates nor further expansion of the BOJ's already huge program of quantitative easing (QE) will be sufficient to offset the strong deflationary forces that Japan now faces.

In 2013 the BOJ predicted that its QE operations would deliver 2 percent inflation within two years. But in 2015, core inflation (excluding volatile items such as food) was only 0.5 percent. With consumer spending and average earnings falling in December, the 2 percent target increasingly looks out of reach.

The unanticipated severity of China's downturn is the latest factor upsetting the BOJ's forecasts. But that slowdown is the predictable (and predicted) consequence of debt dynamics with roots going back to 2008.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.