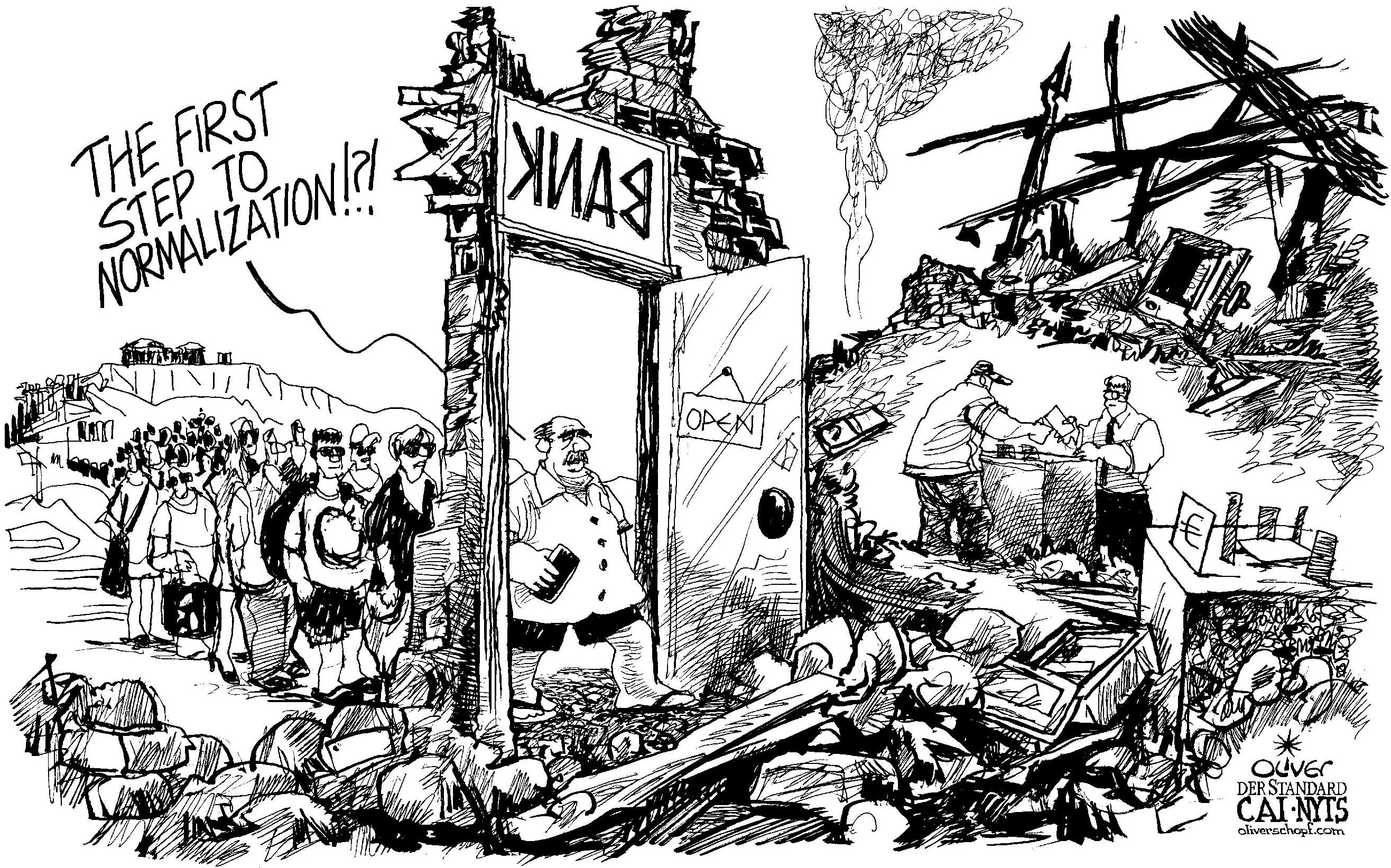

Greece and its European partners may have agreed on a new bailout provision, but how the Greek economic tragedy will actually end remains a mystery. One thing, however, is certain: eurozone governments will end up writing off a large proportion of their loans to Greece. Their refusal to recognize that reality has increased the losses they will suffer.

To be sure, the Greek government has, at times, been provocative and unrealistic, failing to accept, for example, the need for serious pension reform. But the eurozone authorities' refusal to accept the need for debt relief has been equally divorced from reality. Last month, International Monetary Fund Managing Director Christine Lagarde's called for talks to resume "with adults in the room." That means facing facts.

In this sense, the IMF's latest Debt Sustainability Analysis, published on June 26, is a grown-up document. It makes clear that Greece's debts will not be sustainable without further concessional loans and an extension of existing debt maturities; perhaps, it suggests, a write-off of some €50 billion ($55 billion) will also be needed. But even these calculations are based on unrealistic assumptions.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.