Indian Prime Minister Narendra Modi’s trip to the U.S. couldn’t have come at a better time. A buzzing economy, equity benchmarks at record highs and a rapidly growing consumer market all make for a great advertisement as he pitches the country’s potential to American corporate executives and investors.

Stocks in India have attracted a net $8.7 billion in foreign inflows since March, set to be the most in any quarter since the end of 2020. Rupee-denominated bonds are on track to witness the longest streak of monthly buying by overseas funds in almost four years, while the local currency is offering the second-best carry returns in Asia this year, according to Bank of America.

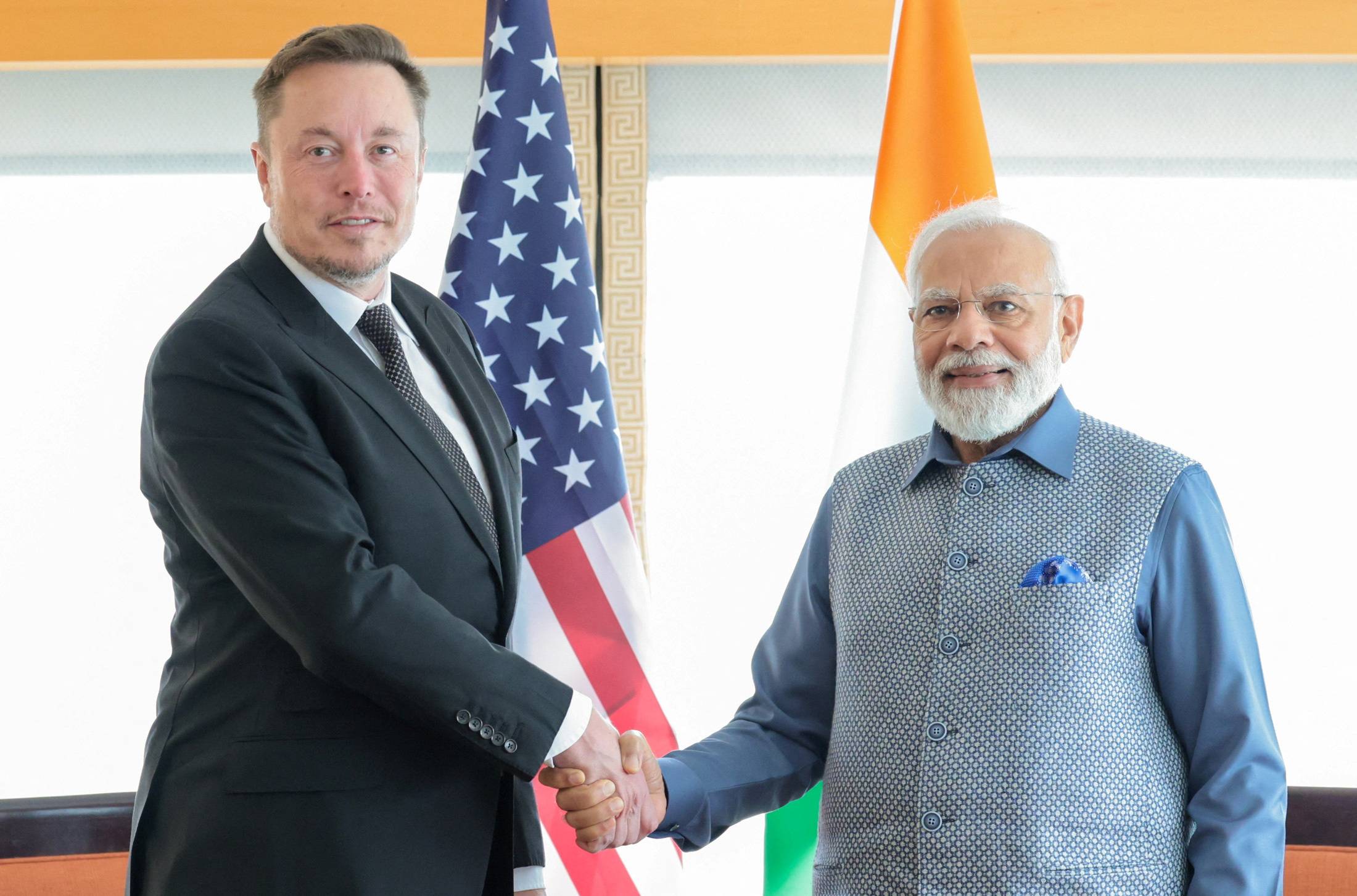

Modi’s visit promises more: Tesla is likely to make a significant investment in India, CEO Elon Musk said after meeting the South Asian nation’s leader, who also urged Bridgewater Associates founder Ray Dalio to deepen investments in the country. General Electric and India’s Hindustan Aeronautics are set to sign an agreement during Modi’s trip to produce engines for India’s fighter jets.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.