Startup-focused lender SVB Financial Group became the largest bank failure since the financial crisis on Friday, in a sudden collapse that roiled global markets and stranded billions of dollars belonging to companies and investors.

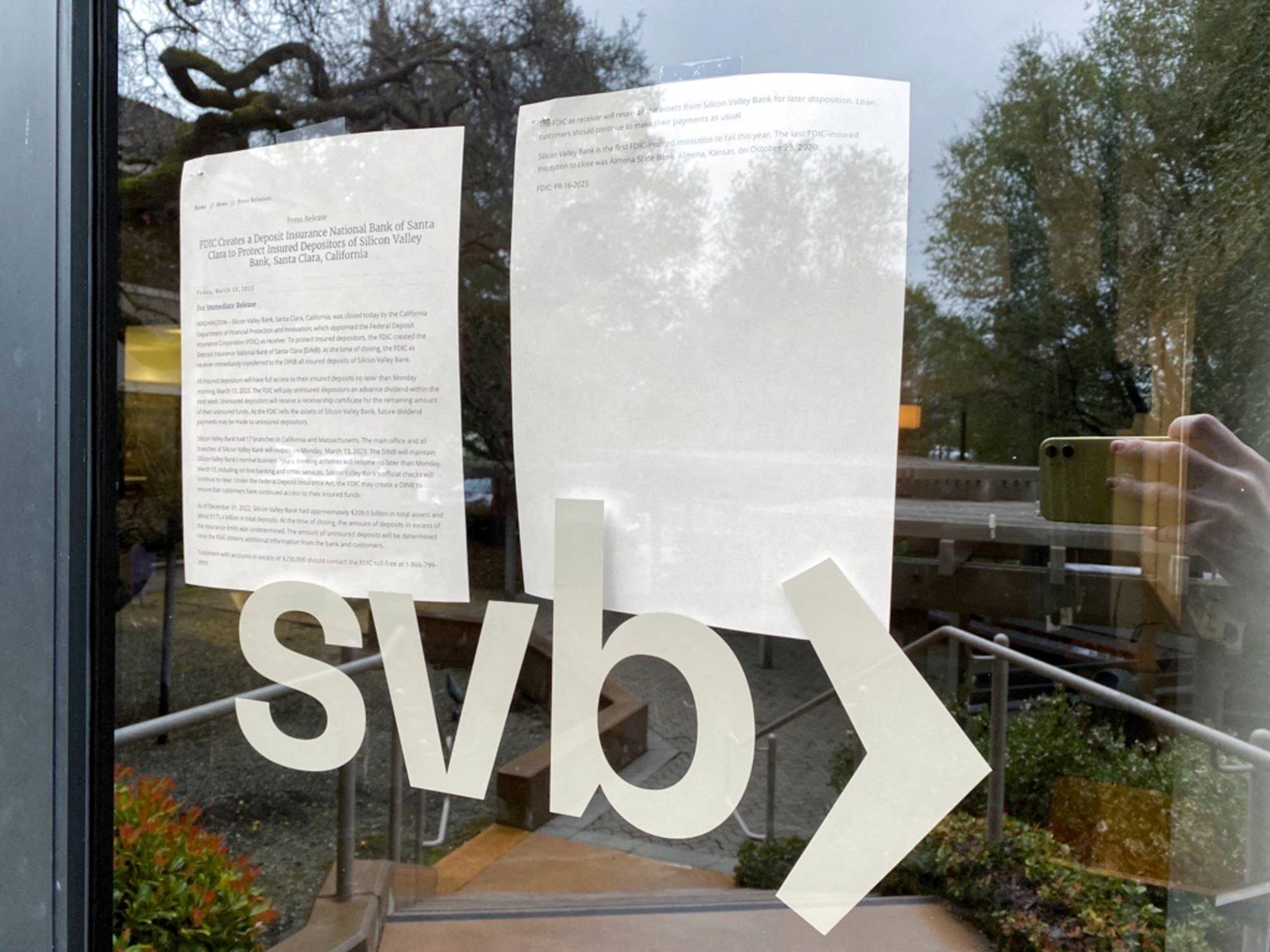

California banking regulators closed the bank, which did business as Silicon Valley Bank, on Friday and appointed the Federal Deposit Insurance Corp. as receiver for later disposition of its assets.

The main office and all branches of Silicon Valley Bank will reopen on Monday and all insured depositors will have full access to their insured deposits no later than Monday morning, the FDIC said.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.