In her two-bedroom apartment on the outskirts of Chinese tech hub Shenzhen, Wang woke to a deluge of messages. One read: "SPC5744PFK1AMLQ9, 300 pc, 21+. Any need?”

Within minutes, the 32-year-old was at her computer in the living room, hurriedly clearing away empty packets of instant noodles and pulling up a spreadsheet. The code referred to a chip produced by NXP Semiconductors and is used in a car’s microcontroller unit. The sender of the message was trying to find a taker for the 300, made no earlier than 2021, that had come into his possession.

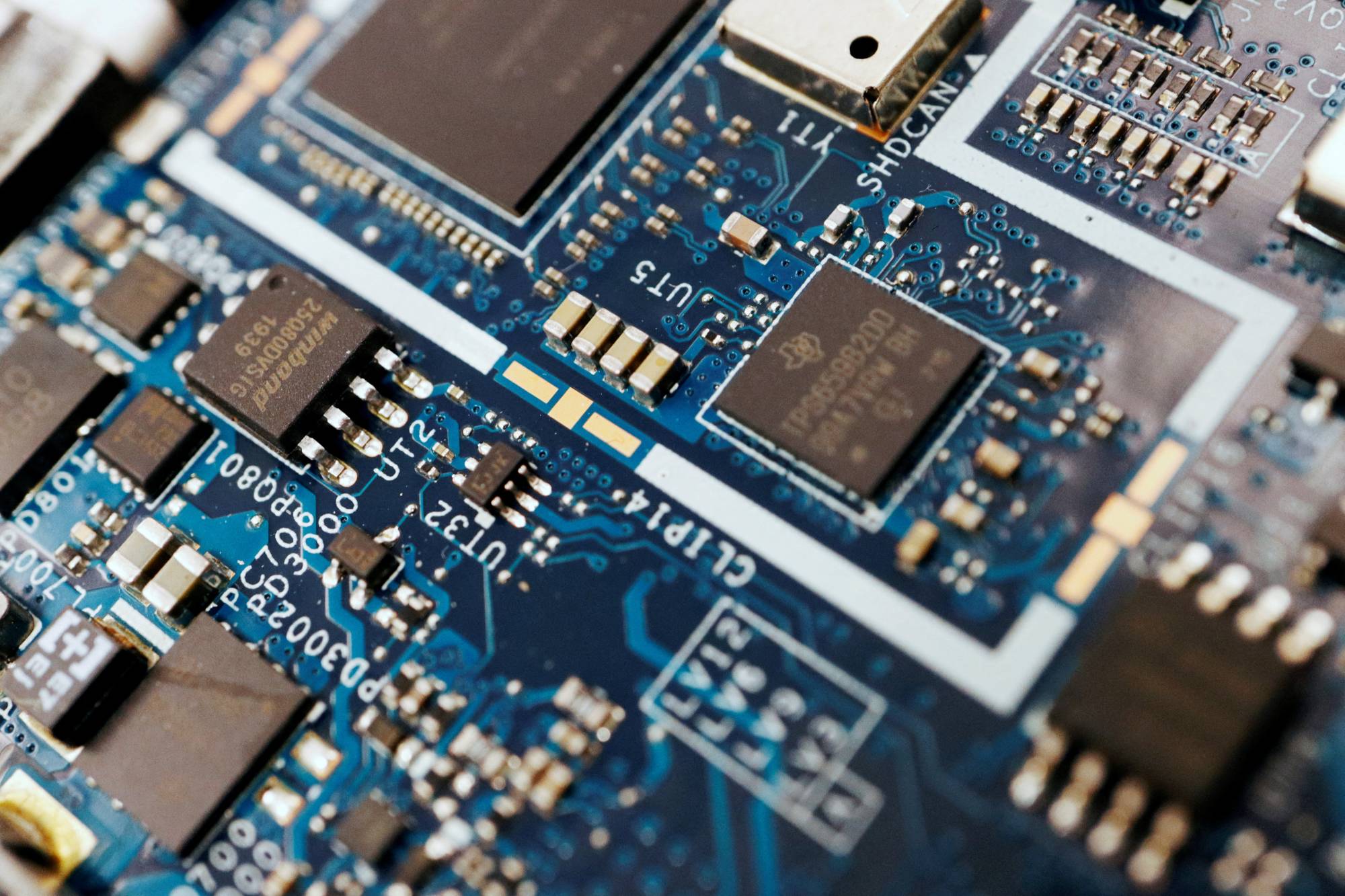

Neither Wang, nor any of her six-member team, are legitimate chip dealers. Freelance brokers like her used to be bit players in China’s semiconductor market, but they became increasingly important in late 2020 when a worldwide shortage of chips began to disrupt supplies of everything from smartphones to vehicles. Now, they’ve formed a massive gray market — an opaque forum populated by hundreds of middlemen and riddled with second-hand or out-of-date chips where the cost of acquiring just one can run to 500 times its original price. The situation is most acute with chips destined for cars, which are becoming more like computers on wheels as the industry is revolutionized. The U.S.’s recent chip technology export curbs will only make the shortages worse, encouraging underground activity, the head of China’s major car association said.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.