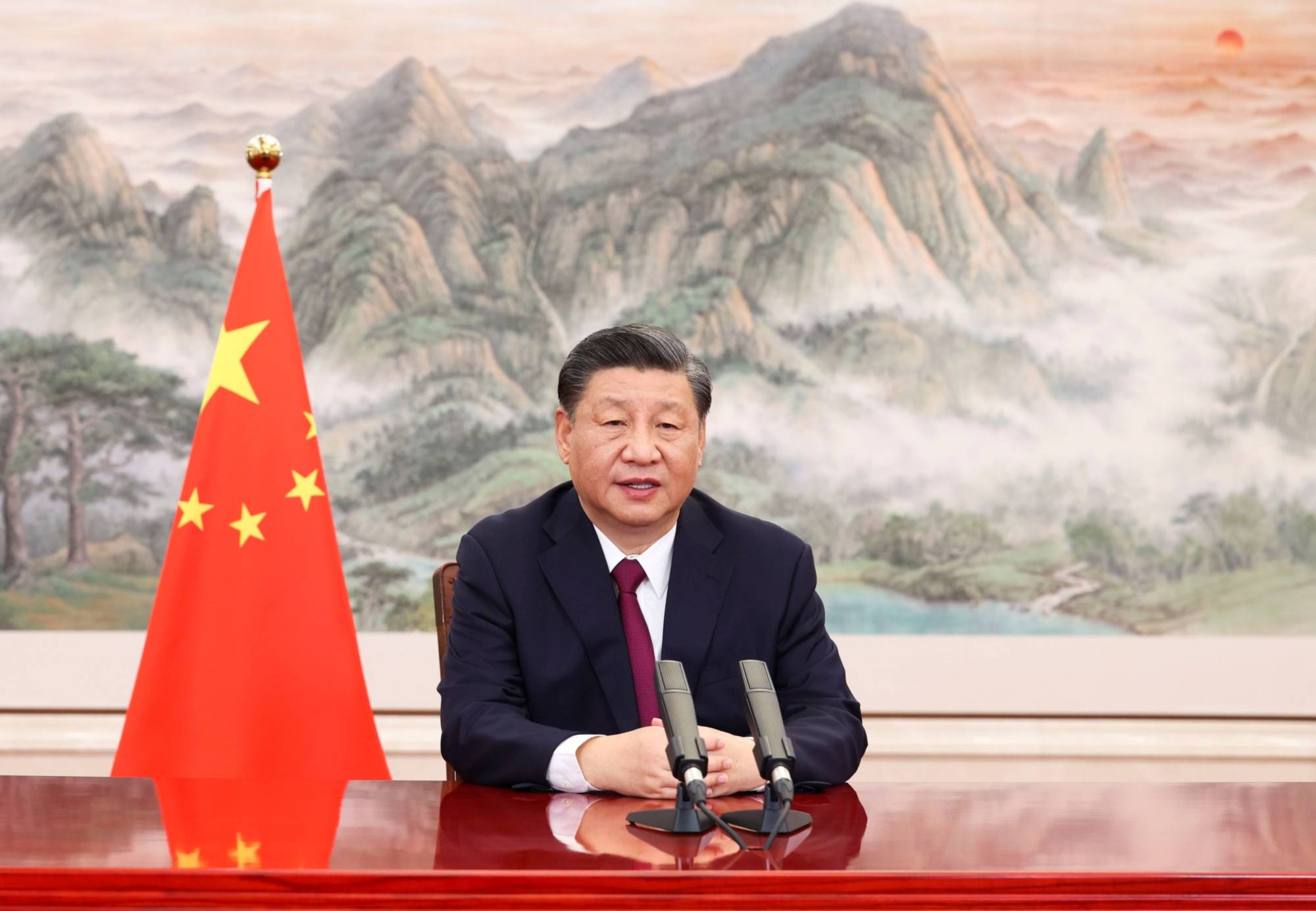

Chinese President Xi Jinping’s corruption crackdown on the nation’s sprawling financial sector is accelerating, reaching the upper levels at some of China’s premier institutions and further unnerving investors having to contend with mounting headwinds for the world’s second-largest economy.

At least 16 officials, including former China Merchants Bank Co. President Tian Huiyu, have been probed or penalized in April, according to announcements from the Central Commission for Discipline Inspection, the top anti-corruption body. That’s in addition to dozens of financial officials that have been ensnared since October when an inspection focused on financial institutions and regulators was launched.

The demotion and subsequent probe of Tian have sent shares of China’s largest retail bank down by almost 20% over the past five days at a time when the nation’s stock markets are already reeling. Investing in China is becoming increasingly precarious as Xi has cracked down on broad parts of the private sector, including the real estate industry and big technology companies. A growing virus outbreak is now further hobbling the economy, putting the government’s 5.5% growth target at risk.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.