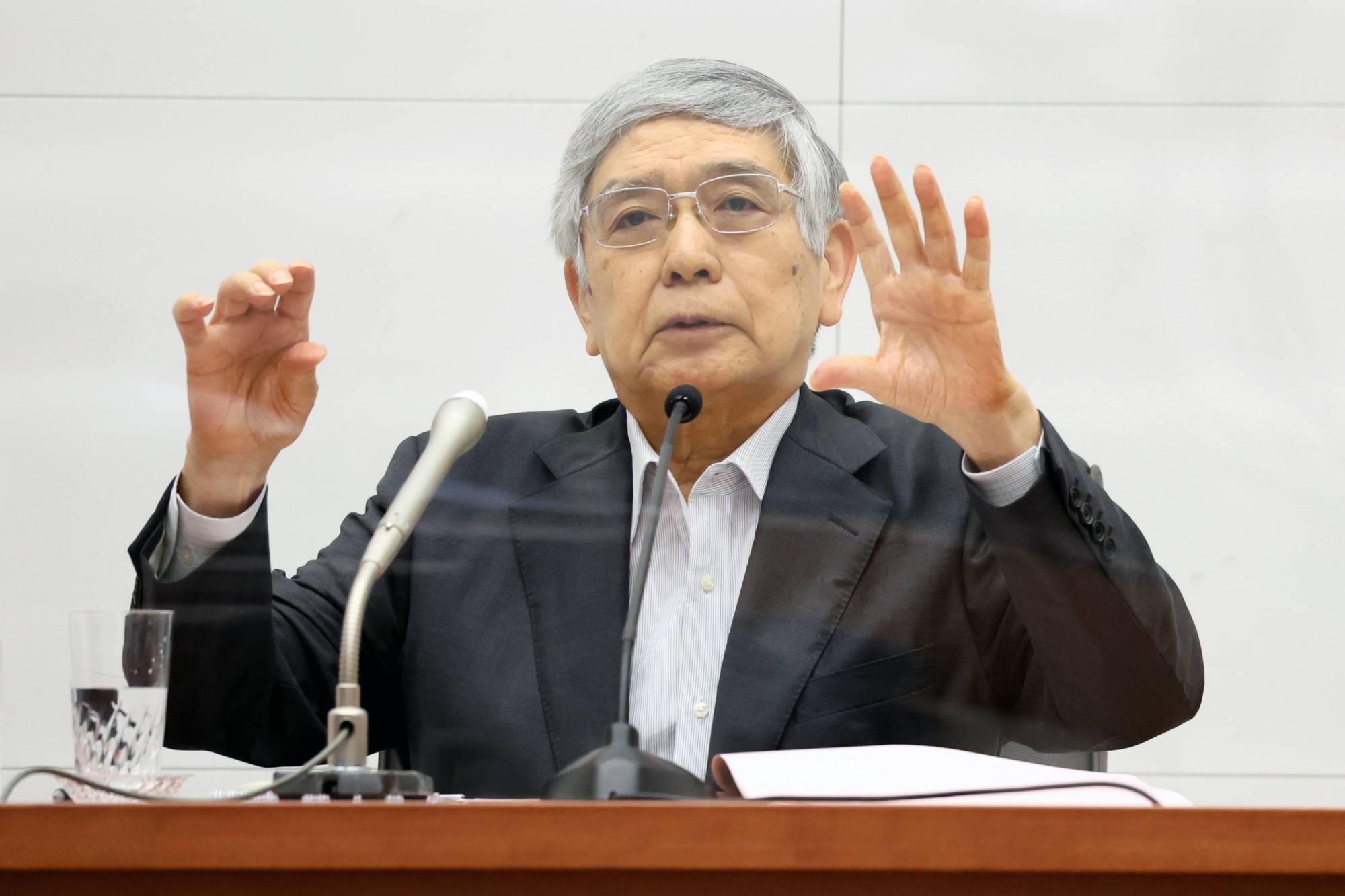

Some Bank of Japan policymakers warned of the risk of a delay in the country's economic recovery as state of emergency curbs to combat the coronavirus pandemic weighed on consumption, minutes of their July meeting showed Tuesday.

While the nine-member board agreed that robust exports and capital expenditure would underpin growth, some also called for more vigilance regarding overseas risks such as the fallout from a possible slowdown in China's economy, the minutes showed.

"A few members said the timing of a full-fledged recovery in Japan's economy was likely to be somewhat delayed" compared with their projections in April, the minutes showed.

"Many members said the overseas economic outlook was highly uncertain with various risks," the minutes showed, citing one member as saying the possibility of China's economy decelerating "should be borne in mind."

"If the rise in U.S. long-term interest rates accelerated, we must be vigilant to the risk of capital outflows from emerging economies," another member was quoted as saying.

The remarks shed light on policymakers' concerns over the fragile state of Japan's recovery, even as they maintained the view that the world's third-largest economy was headed for a moderate rebound from last year's pandemic-induced doldrums.

At the July 15-16 meeting, the BOJ kept monetary policy steady but cut this year's growth forecast from April as state of emergency curbs to combat the pandemic hit consumption.

Slow vaccinations and a spike in delta variant cases forced Japan to extend the curbs through September, building up the strain on some businesses.

The government is set to lift the state of emergency from next month due to recent declines in new cases, which may give the economy a much-needed boost from pent-up demand.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.