It's a Chinese property owner that's in distress, but the shares of American social media and auction companies are tumbling. The chain reaction may say more about the extreme altitude of global risk assets than it does about economic contagion.

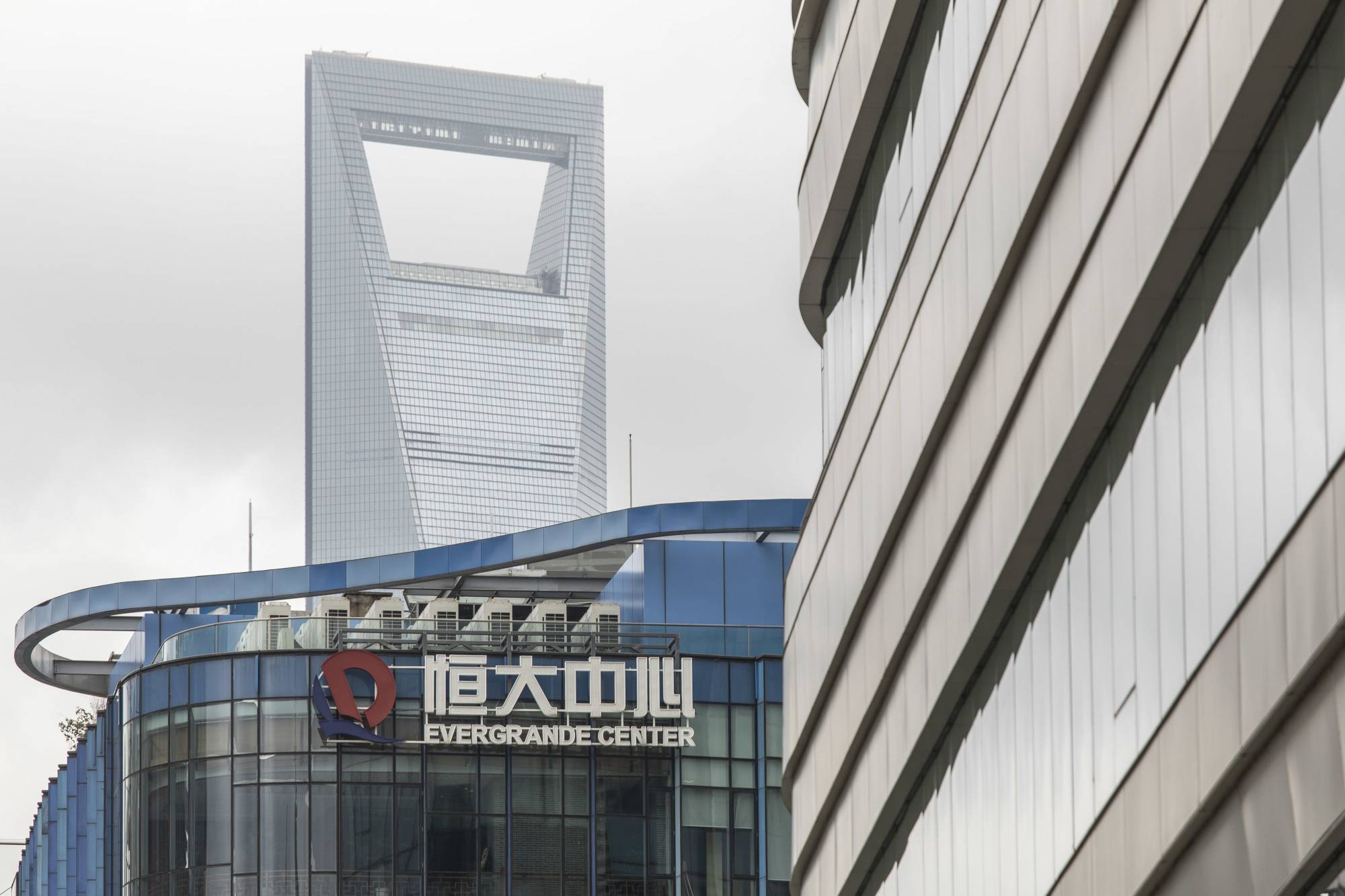

While it doesn’t require excessive sleuthing to understand why commodity and bank stocks are quaking in the vortex surrounding Evergrande, the link with a stock like Twitter Inc. or EBay Inc. is harder to see.

"You’ve got a whole basket of things to be concerned about — throw this headline into the mix and that throws everything askew. So there’s going to be irrational de-risking taking place that doesn’t connect logically,” said Art Hogan, chief strategist at National Securities, of the Evergrande crisis. "Does it make sense for technology stocks to be selling? No, but in a risk-off scenario, everything tends to be for sale — even cryptocurrencies.”

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.