Helping big polluters transform into greener enterprises is one of the biggest challenges facing Japanese banks, and simply cutting off funding for "brown” companies could jeopardize those transition efforts, said the head of the country’s banking group.

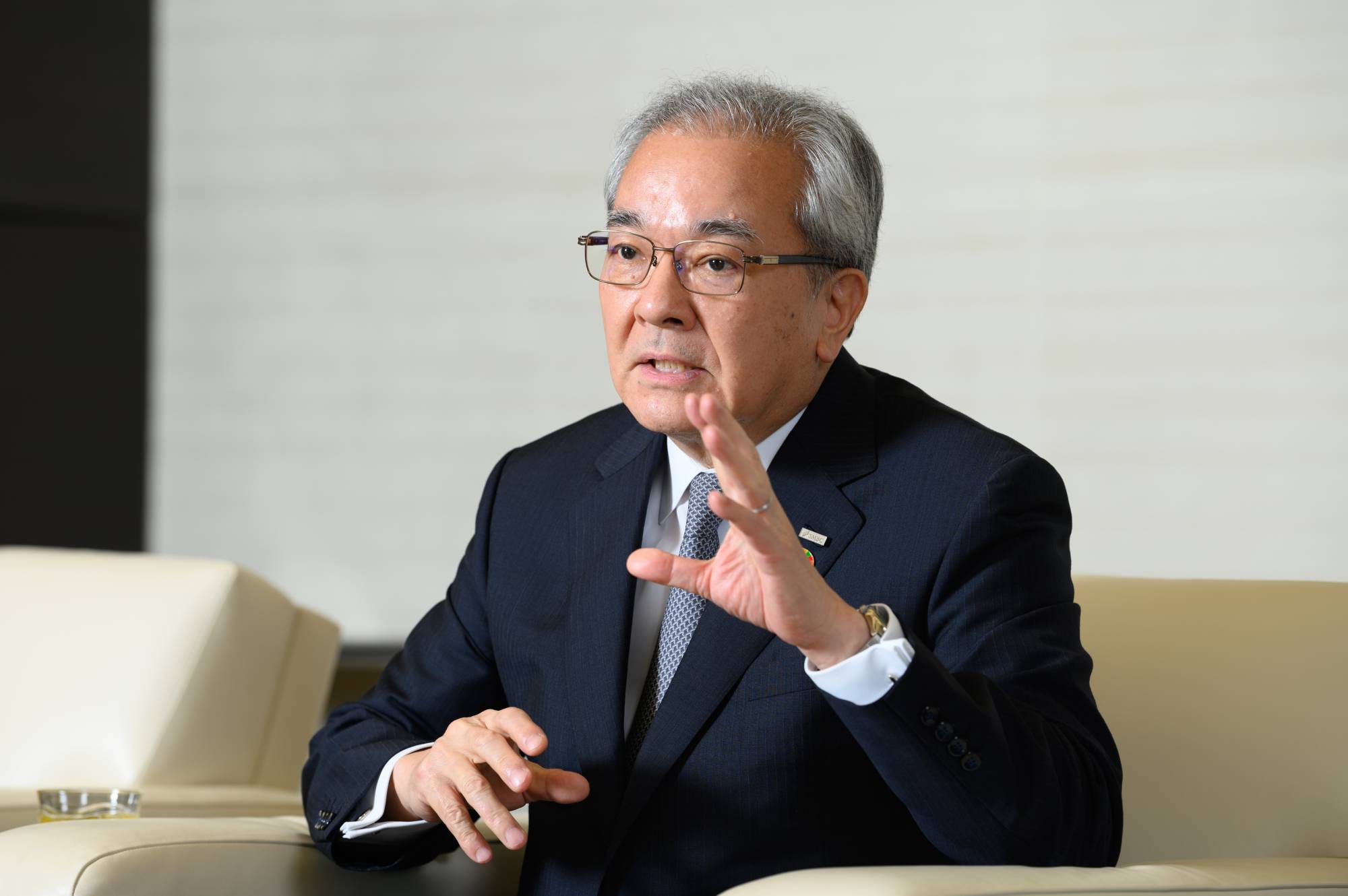

"Discussions often lead to a rather dualistic thinking of lending money to green companies and not to brown ones,” Makoto Takashima, chairman of the Japanese Bankers Association, said in an interview. "We need to provide financial support to transition.”

Takashima’s push to back firms making this pivot underscores the delicate balancing act facing global lenders as they shift from financing fossil fuel industries to greener companies and projects. Green bonds and loans from the global banking sector exceeded the value of fossil financing for the first time this year, an unprecedented reversal since the clinching of the Paris Agreement in 2015.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.