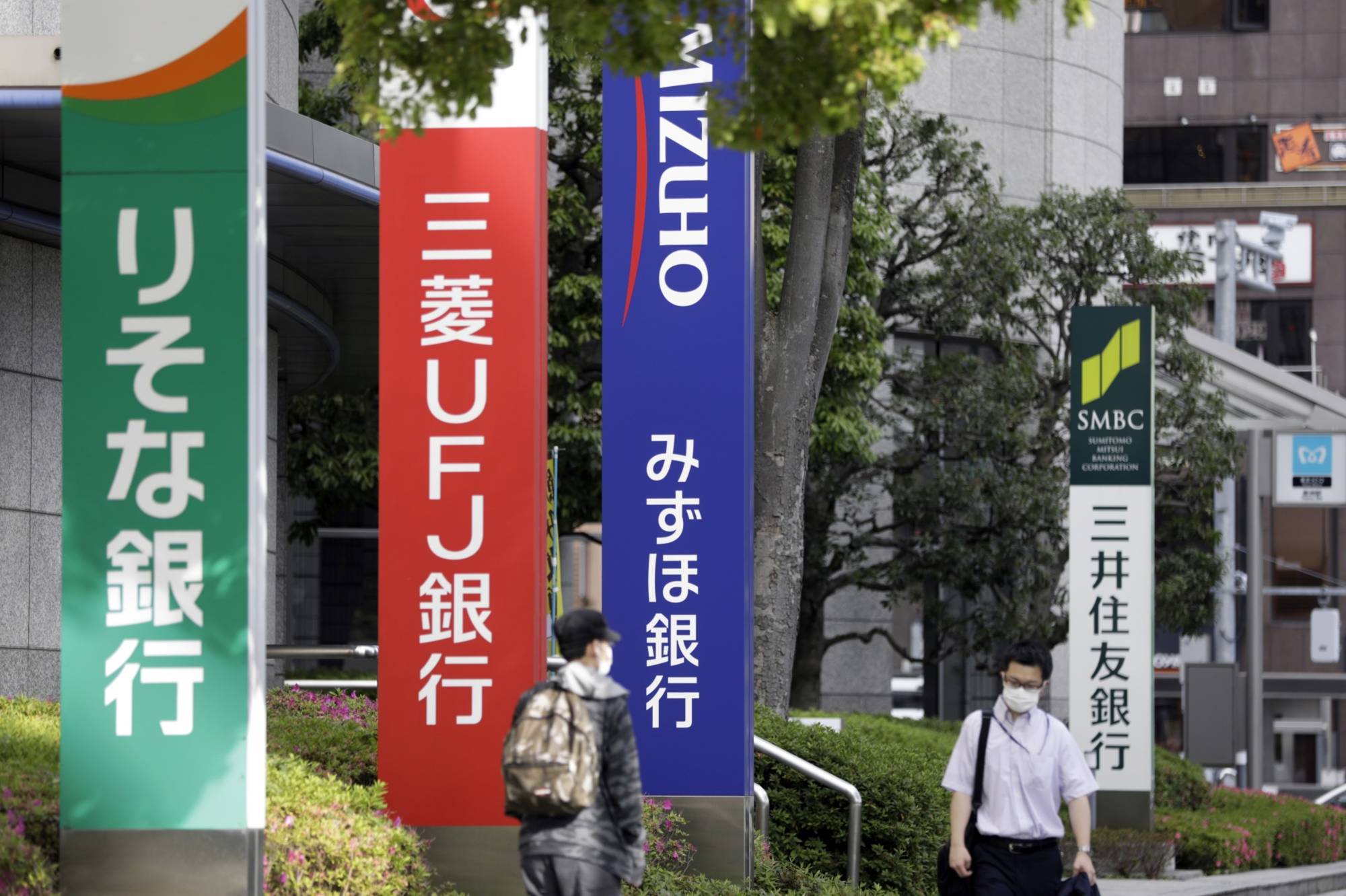

Japan’s biggest banks have a ¥4.6 trillion ($44 billion) problem: how to sell stakes in their most important clients without losing their business.

The lenders have offloaded trillions of yen in cross-shareholdings in the past decade under pressure from regulators and investors. Now they are down to a clutch of firms that are resistant to stake sales, according to interviews with more than half a dozen bank officials, who asked not to be identified because of the sensitivity of the discussions.

Firms have threatened to take their business elsewhere if lenders sell their holdings, said one senior executive at a major bank. Such resistance is leaving banks in a bind as they seek to improve corporate governance and shore up their finances through divestments.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.