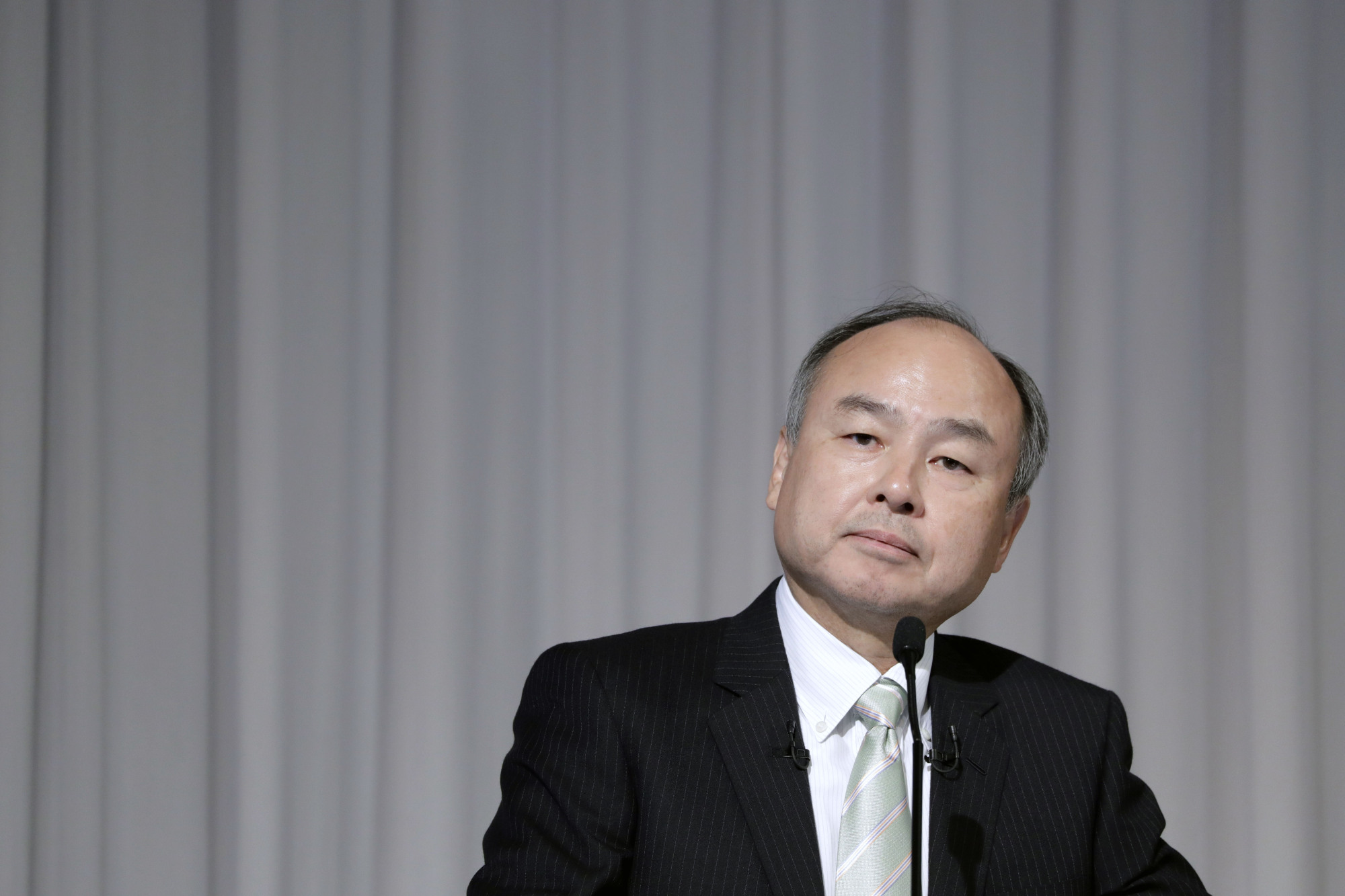

SoftBank Group Corp. founder Masayoshi Son opened the door to making at least some of the changes championed by activist investor Paul Singer, after the company reported a second quarter of losses from its startup investing.

Son called Singer's Elliott Management Corp. an "important partner" and said he is in broad agreement with the investor about SoftBank buybacks and share value. Son said he is on the side of shareholders, especially since he is the largest stockholder at the company. The two billionaires held discussions a couple weeks ago, he said.

Son is adopting a more conciliatory stance just as he's stumbling with his signature effort — the $100 billion Vision Fund, which made him the biggest investor in technology. The fund lost money in the quarter ended in December, a quarter after the meltdown at WeWork triggered a record loss for the company. On Wednesday, Son said he is no longer targeting $108 billion for a second fund and that SoftBank may finance the effort on its own.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.