Paul Singer earned his reputation as a take-no-prisoners brawler by challenging the interests of Argentina's government and South Korea's family businesses. With his latest investment, though, the American activist investor appears to be taking a more collaborative approach.

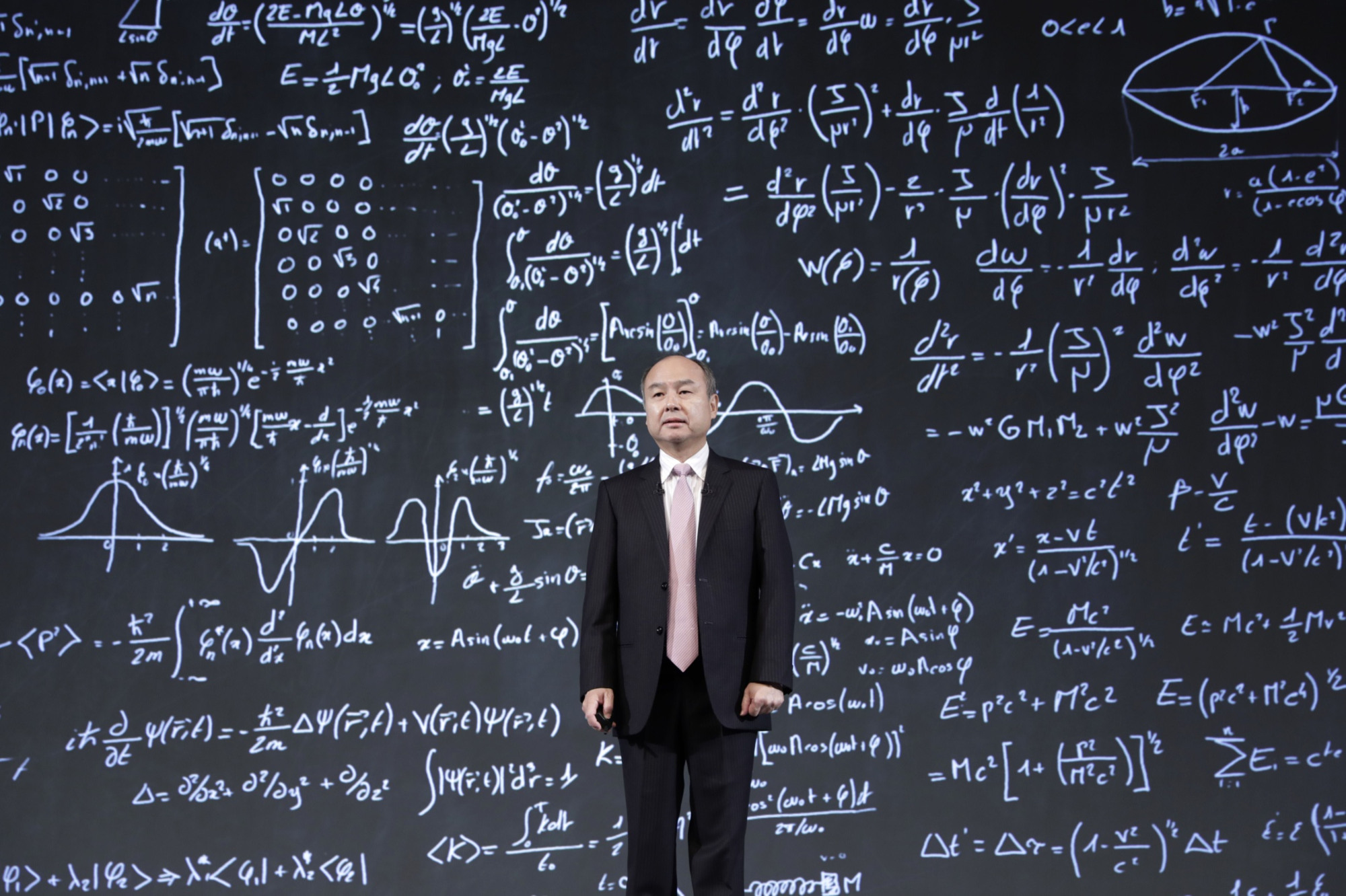

Singer's Elliott Management Corp. took a stake of almost $3 billion in SoftBank Group Corp., saying the Japanese company's shares are woefully undervalued compared with its assets. That's exactly the argument SoftBank founder Masayoshi Son has been making for years.

Son is finding himself pleading the case more frequently after a series of stumbles in recent months. WeWork's plan to go public imploded, forcing SoftBank to arrange a rescue financing of $9.5 billion in October. Uber Technologies Inc. continues to underperform. At least two managing partners of SoftBank's $100 billion Vision Fund have left since December, and the company is struggling to secure investors for its second technology fund.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.