Nissan Motor Co. may be a smaller player in the U.S. auto market without its longtime leader. Sales that were already slipping much of this year probably tailed off again in November, the month the carmaker ousted Carlos Ghosn as chairman.

Nissan deliveries probably will drop about 16 percent this month, according to analysts' average estimate in a Bloomberg News survey. That would be the steepest decline since April.

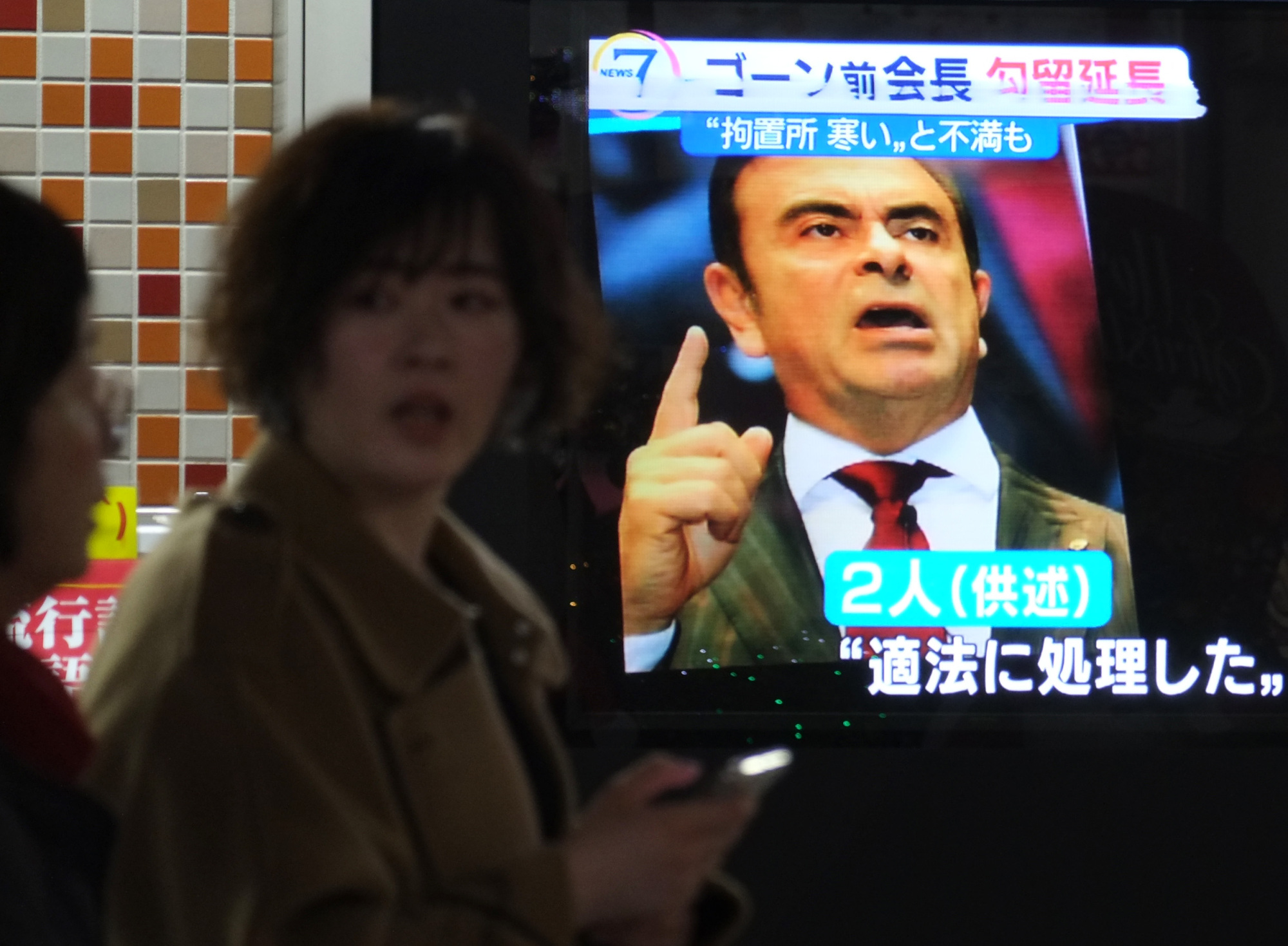

Ghosn, who's been jailed in Japan over allegedly understating his income and misusing company funds, set an ambitious target years ago for Nissan to reach 10 percent market share in the U.S.

In pursuing that goal, Nissan used big discounts and boosted less-lucrative deliveries to rental-car fleets. Nissan has said it may back away from that strategy, but the automaker will be challenged by a softening auto market that will require more deals to move the metal, according to Michelle Krebs, an analyst at Autotrader.

Analysts expect better sales results for the rest of the major automakers in the U.S., with Fiat Chrysler Automobiles NV projected to post another big gain on the strength of Jeep SUV sales. But most companies will still probably be down from a year ago.

One way Nissan has definitely been more disciplined of late has been by dialing back production. Wholesales are down about 90,000 vehicles this year, Denis Le Vot, chairman of the company's North American operations, said in an interview at the Los Angeles Auto Show.

The lower factory output has dropped Nissan's inventory to about 68 days' supply as of Nov. 1, from 88 days at the beginning of May, according to Automotive News Data Center.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.