After a blistering year-and-a-half long surge, a sudden drop in some memory chip prices followed by Samsung Electronics Co.'s disappointing profit estimate is causing jitters among investors who had bet the chip boom would last at least another year.

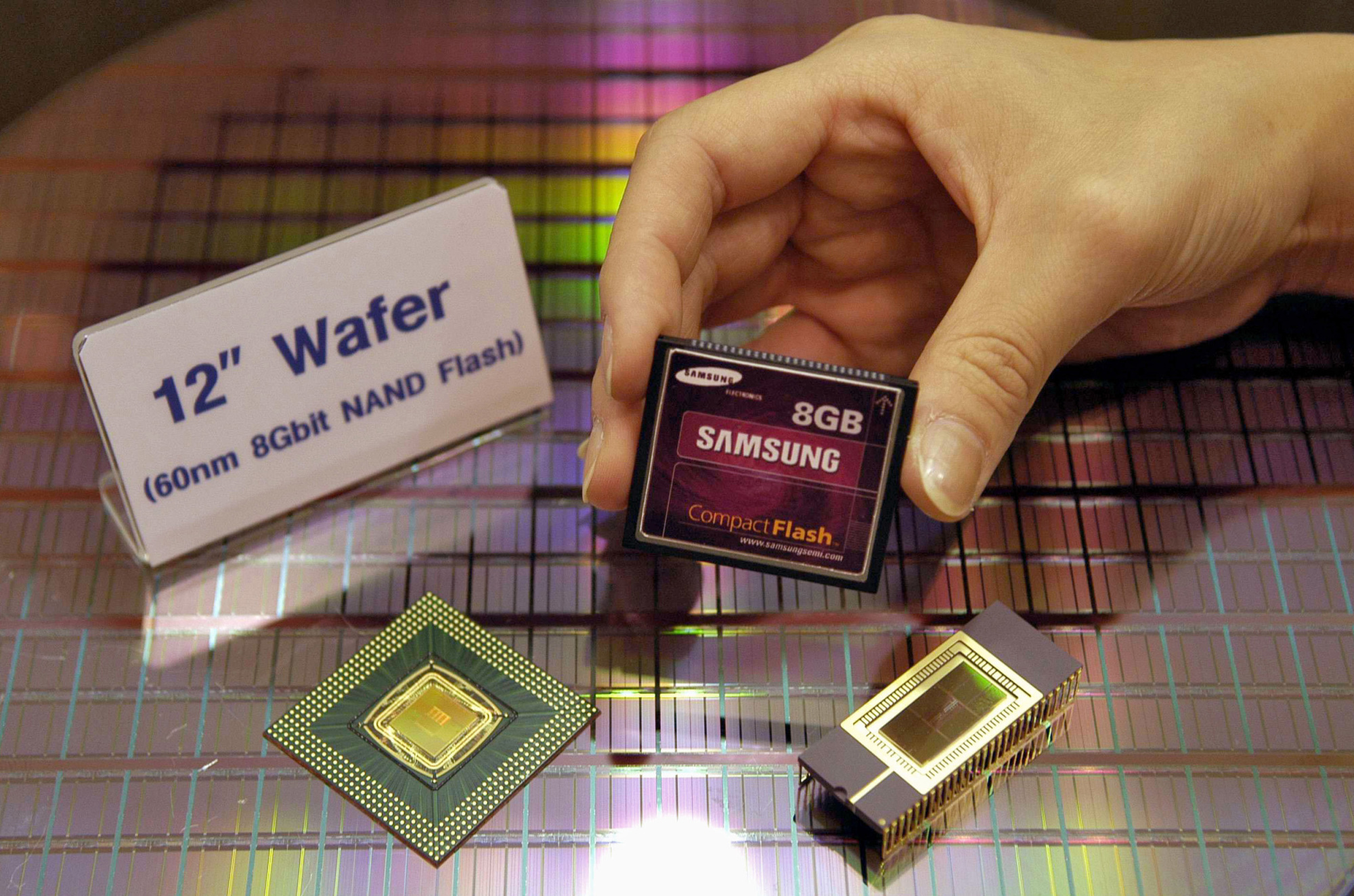

Amid news that the market has started losing some steam — prices of high-end flash memory chips, which are widely used in smartphones, dropped nearly 5 percent in the fourth quarter — some analysts now expect the industry's growth rate to fall by more than half this year to 30 percent.

That led shares in Samsung to dip 7.5 percent last week, while its home rival SK Hynix Inc. fell 6.2 percent. But analysts say that there is unlikely to be a sudden crash, and that 2018 should be a relatively stable year for chipmakers.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.