A rift is emerging between Prime Minister Shinzo Abe and his hand-picked central bank boss on how to fix Japan's tattered finances, which could blunt the impact of the "Abenomics" stimulus policies they have worked together to prosecute.

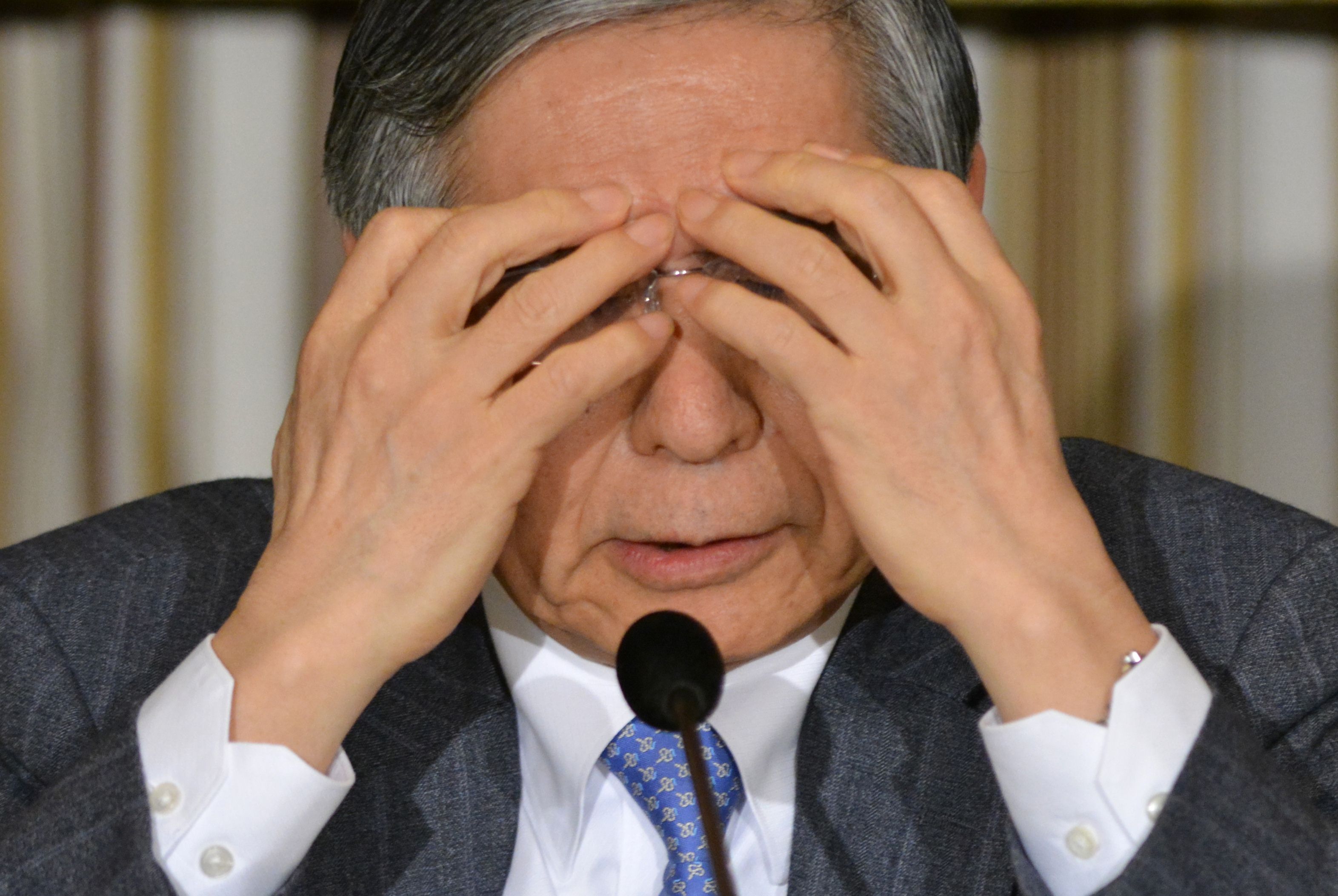

Two years into Bank of Japan Gov. Haruhiko Kuroda's tenure, the cracks are becoming hard to conceal and could affect the timing of any further monetary easing and an eventual end to the massive money-printing program he set in motion.

Their differences over fiscal policy needed to cut Japan's staggering public debt, which at 230 percent of GDP is twice the U.S. figure and about 50 points higher than perilous Greece, have so far been masked by their shared determination to end deflation.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.