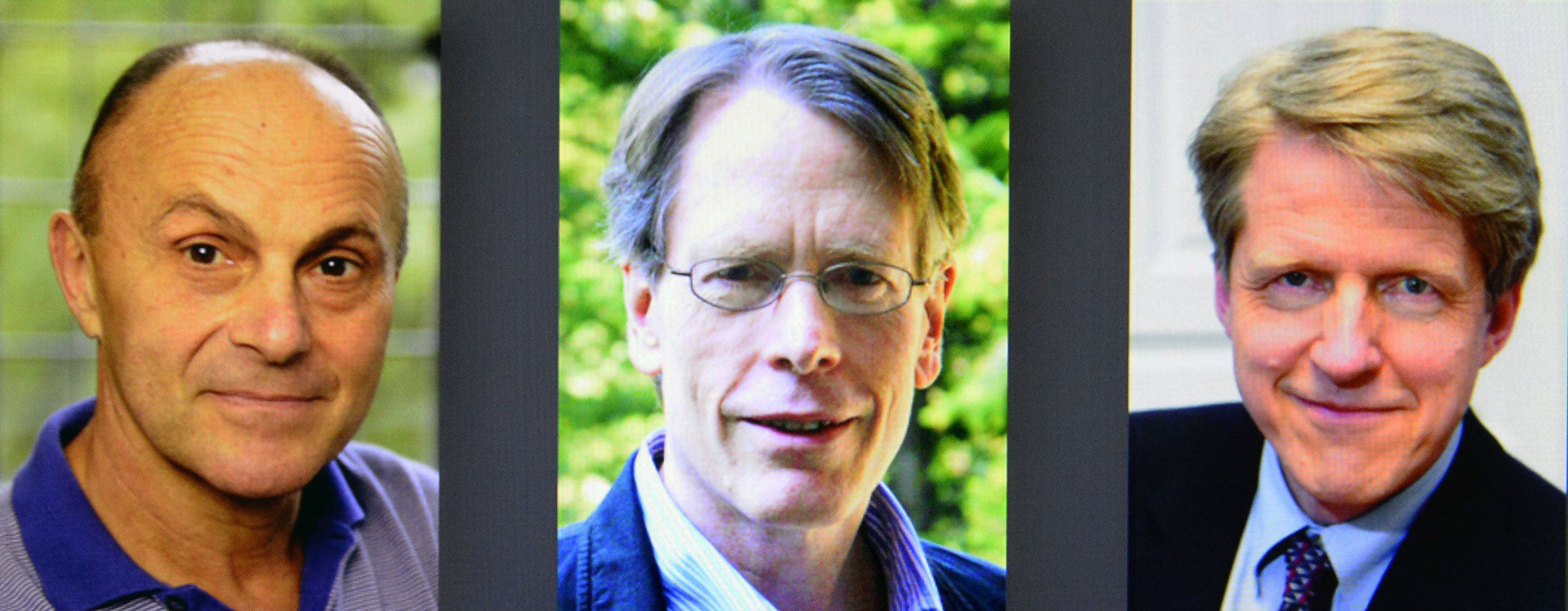

Eugene F. Fama, Robert J. Shiller and Lars Peter Hansen shared the 2013 Nobel Prize in Economic Sciences for their work toward creating a deeper understanding of how market prices move.

"The Laureates have laid the foundation for the current understanding of asset prices," the Royal Swedish Academy of Sciences, which selects the winner, said today in a statement in Stockholm. "It relies in part on fluctuations in risk and risk attitudes, and in part on behavioral biases and market frictions."

Fama, 74, known among economists as the "father of modern finance, is a professor at the University of Chicago. In the mid-1960s he propounded theories that argued that stock-price movements are unpredictable and follow a "random walk," making it impossible for any investor, even a professional, to gain an advantage. He also showed in later work that so-called value and small-cap stocks have higher returns than growth stocks, and he rejected the notion that markets often produced bubbles.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.