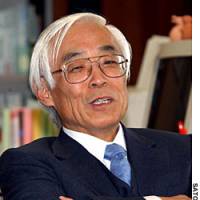

The issue of whether to raise the consumption tax will come to a head in fiscal 2009, although the margin and timing of any increase will be a political decision, the government's Tax Commission Chairman Hiromitsu Ishi said in a recent interview with Kyodo News.

The government is increasingly in need of securing new revenue sources as it is scheduled to raise public funding to the basic pension program from the current one-third to 50 percent in fiscal 2009.

"We determined the direction for taxes on income in June when we sorted out what the issues are," said Ishi, who heads the tax advisory panel to the prime minister.

Ishi said the maximum income tax rate, combining that of both the central and local governments, is likely to be capped at the current 50 percent.

"Thus, it is instead necessary to fully look into taxes on capital income, including dividends, interest and capital gains," Ishi said. "That is most important."

In addition, Ishi said the panel will discuss whether to lower the current tax exemption limit on inherited wealth, adding that a cut in the corporate tax may also be necessary.

Ishi said he had the feeling during a recent visit to the United States that Washington is studying the possibility of lowering its corporate tax.

If the United States lowers the tax, Ishi said he believes it is inevitable that Japan will also do so.

The Tax Commission will issue a set of recommendations in September on how best to reform Japan's tax system from a midterm perspective as part of efforts to rebuild its debt-laden finances.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.