About a year ago, we talked about using real estate purchases to lower inheritance and gift taxes. Obviously, people who are able to take advantage of these schemes are already well off — the average person doesn't have to worry about paying inheritance taxes when his or her parents die because for most people there aren't enough assets involved.

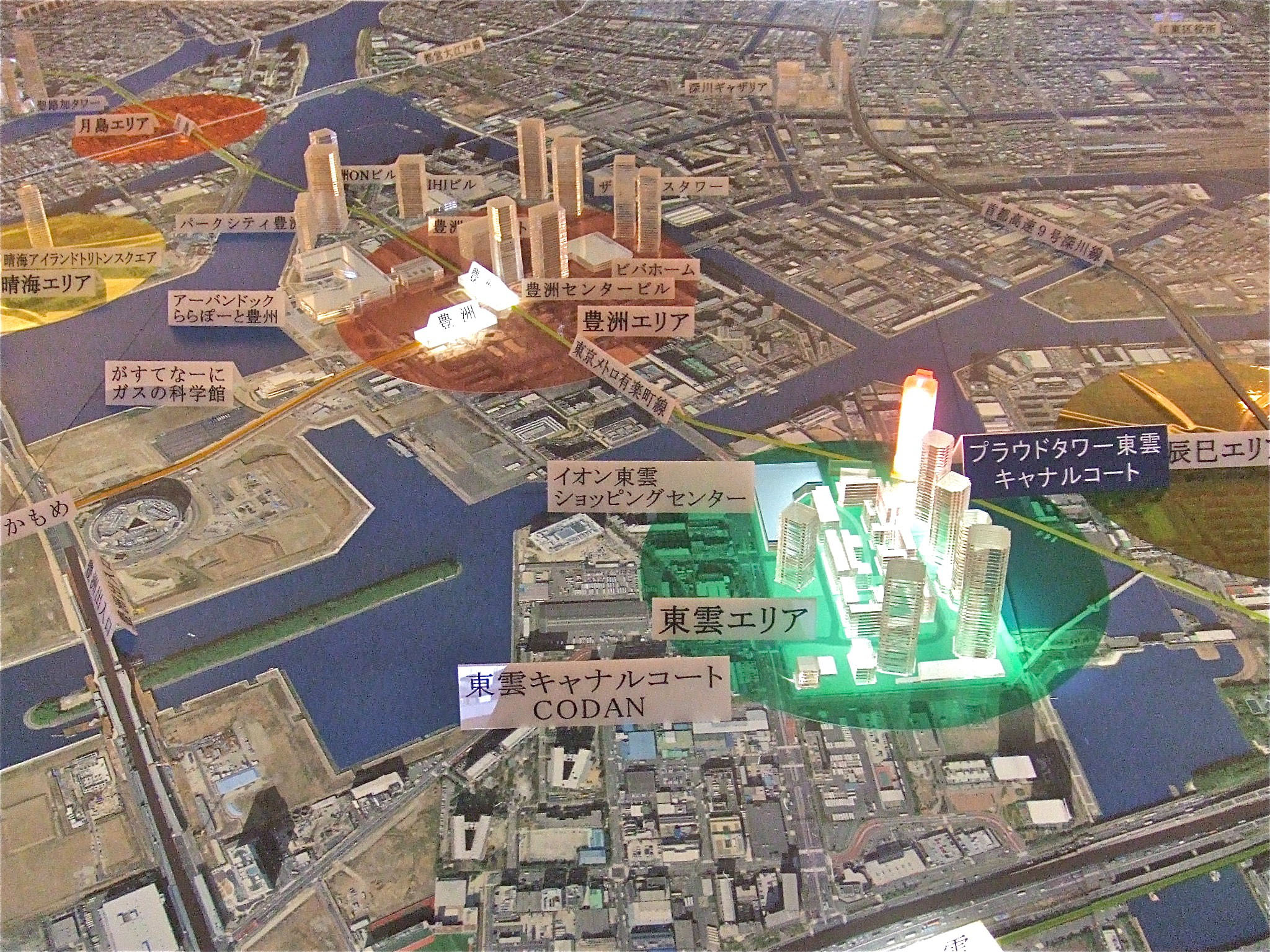

But in the past few years it has emerged that quite a few people of means have found ways of passing on large inheritances without paying any taxes at all, sometimes even before they die. The methods seem to be legal, but last year the National Tax Agency realized how much money it was losing and started cracking down on people who used these methods. According to an article that appeared in the Asahi Shimbun in November, the agency has ordered local tax bureaus nationwide to investigate transactions related to so-called tower condominiums, because the purchases of such units are often used to hide legacies.

The secret to the scheme has to do with the assessment of assets, which is carried out by tax officials to determine the value of a person's property for inheritance and gift tax purposes. When the property is a condominium, the assessment is in two parts: one for land, and the other for the actual unit. The land assessment will likely be small, since the actual land value is assessed and then divided among all the units in the building, so the more units there are, the smaller the value. As for the value of the unit itself, the differences from one apartment to another in the same building are based on floor area. That's all. A 70-square-meter unit on a higher floor will have the same assessed value as a 70-square-meter unit on a lower floor.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.