A top-performing Taiwan tech fund expects sustained demand for artificial intelligence to keep driving an upward trend in the semiconductor cycle despite growing doubts that valuations in the sector are too hot.

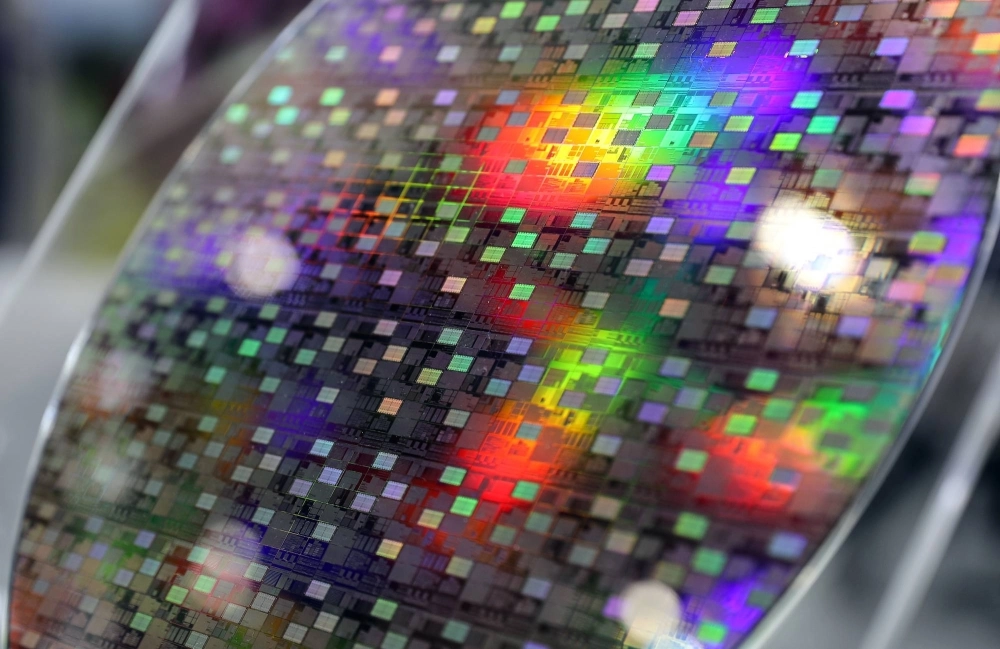

The NT$1.37 billion ($42 million) UPAMC New Asian Technology and Energy Fund, run by Uni-President Asset Management Corp.’s Sam Kuo, is up 45% this year, according to available data. It’s outperformed 98% of peers. The fund’s biggest holdings include Nvidia, Taiwan Semiconductor Manufacturing Co. (TSMC) and Micron Technology.

"We don’t think we see a tech bubble happening right now,” said Kuo. Some stock valuations may even increase 60% to 70% this year even though their profits have only been revised up by 20% to 30%, leaving room for earnings to catch up, he added.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.