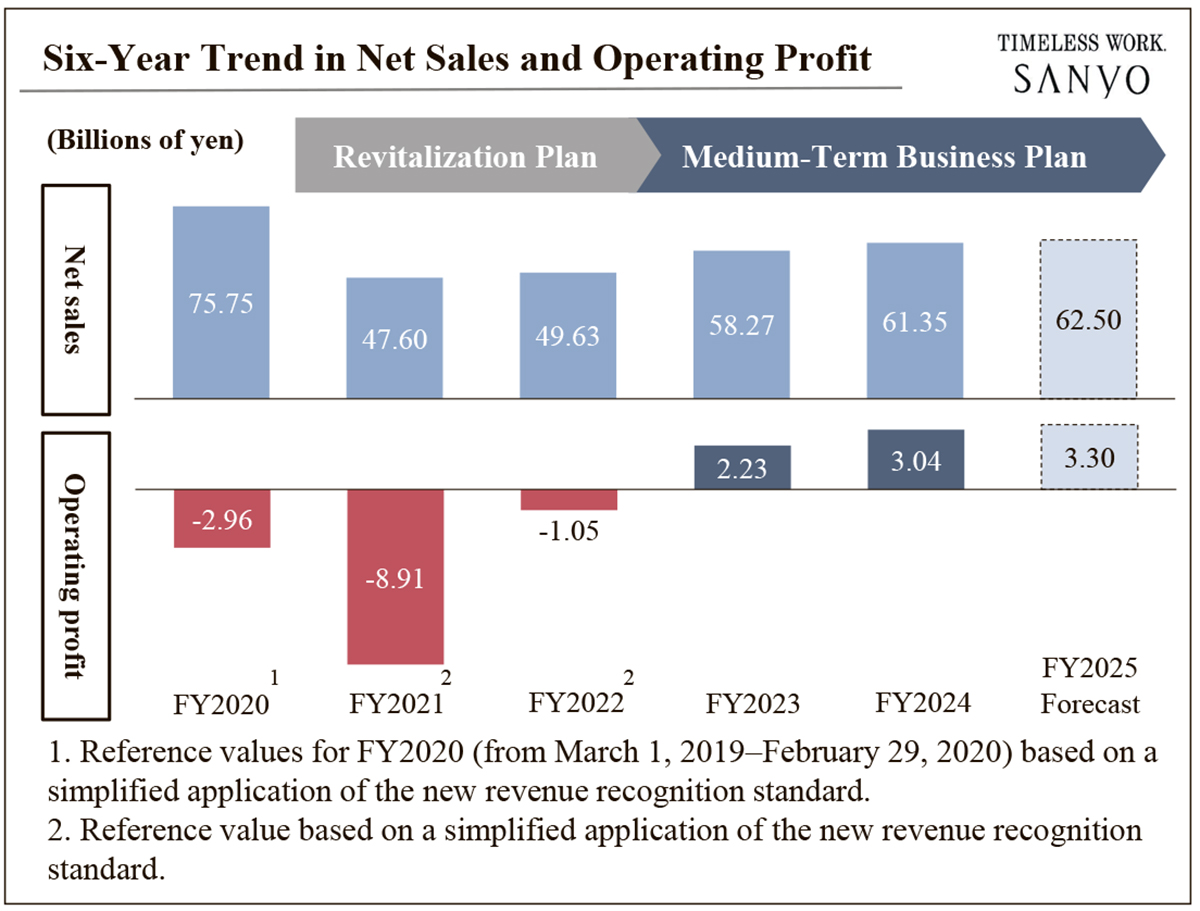

Sanyo Shokai Ltd., a Japan-based company with over 80 years in the manufacture and sales of apparel, confirmed in its recent midterm briefing of accounting reports the continuation of the recovering trend of its financial performance. The company had experienced a significant drop in operating profit due to the loss of its sales license for its long-standing flagship Burberry brand in 2015 and the coronavirus pandemic.

“Even without the core brand, the company refused to downsize and the business plan was designed on what the company should or should be able to do based on wishful thinking and expectations,” Representative Director, CEO and President Shinji Oe said in a recent interview with The Japan Times, looking back on the time before he became president.

As soon as he took up the position in 2020, he created a two-year revitalization plan through 2021. “The plan was premised upon the realistic sales based on our company’s real ability. We formulated measures to ensure fiscal balances based on the minimum sales prospect,” he said.

One of the measures was cost reduction in procurement and operations. “We made sure that all purchases were negotiated to achieve the cost ratio of 25% or lower, and downsized to cut manpower costs that account for a large proportion of operational costs,” he said. With concurrent efforts in other areas, the company succeeded in reducing operational costs by one-third.

Sanyo has also optimized its inventory to focus on selling full-priced items in a bid to reduce the amount of excess inventory that can only be sold at markdown prices.

Oe admitted that due to the coronavirus pandemic, not everything went as planned. “But this unforeseen event acted as a strong stimulant to accelerate our structural reforms with a shared sense of crisis,” he said.

On the other hand, the company has been committed to retaining high product quality. Sanyo’s main target in the ¥9 trillion apparel market in Japan is the upper of the middle range sandwiched between luxury and low-end, fast fashion. The seven core brands that the company focuses on, including Blue Label/Black Label Crestbridge, Mackintosh London and Paul Stuart, all fall in this category. “This segment accounts for 8% to 15% depending on the definition. But I believe that it has potential for growth if we can continue to provide high-quality items that are as good as luxury brand items at relatively reasonable prices,” he said.

2024 is the final year of a three-year medium-term business plan implemented following the initial two-year revitalization plan. “As previously announced, we achieved the results that far exceeded the planned figures in the first two years,” Oe said. Although operating costs have increased slightly this year, this is not due to negative causes. “We are returning the profit to our employees by improving their working conditions because a steady enhancement of the company’s performance is the result of their efforts,” he said. Not only that, but the company is promoting the increase of returns to its shareholders. The renewal of its e-commerce site, the opening of new stores and an enhanced sales promotion also had an impact on the increase in operating costs, but the overall progress of the annual plan is on track.

“We are getting closer to our goal of growing sales of each of our seven core brands to ¥10 billion, creating a balanced portfolio supported by seven equally solid pillars instead of a single flagship brand,” Oe said.

In recent years, the company has also focused on several brands that bear the name of the company such as Sanyocoat, whose items are characterized by the company’s commitment to quality. “In the future, we aim to aggregate these brands to make our top-of-the-range series,” Oe said.

For more information, please visit:

https://www.sanyo-shokai.co.jp/en/

Japanese

https://www.sanyo-shokai.co.jp/company/interview/

English

https://www.sanyo-shokai.co.jp/en/company/interview/