In his book “A Brief History of the Future: A Brave and Controversial Look at the Twenty-First Century” (2006), Jacques Attali predicted two industries would emerge as the most influential of the 21st century — entertainment and insurance.

According to his book, it is because in periods of uncertainty, people will look to the entertainment industry for something enjoyable and to the insurance industry for a safety net.

What the French economic and social thinker predicted has already proven true, given the success of Netflix and increasing demand for insurance amid the COVID-19 pandemic and the growth of natural disasters worldwide, said Takeshi Kimura, a special adviser to Nippon Life Insurance Co. “But what he didn’t see coming was the emerging role of insurance companies as institutional investors involved in ESG (environmental, social and governance) investment.”

“The role of insurance companies isn’t merely offering insurance products to hedge future risks and uncertainties. They also play the role of asset owners to create flows of capital and realize a safe and sustainable society through ESG investment,” Kimura said in a recent interview in Tokyo. “By having two such roles, there is something that only insurance companies can offer to society.”

As a leading private institutional investor in Japan, Nippon Life is spearheading a movement to support activities to achieve the sustainable development goals adopted by the United Nations through ESG investment and loans with a long-term perspective.

The SDGs were adopted in 2015 and consist of 17 targets, such as ensuring access to clean and sustainable energy, reducing inequality and conserving sustainable oceans.

Beginning in April, the company began to incorporate ESG factors into all investing processes across its ¥70 trillion portfolio.

Moreover, the nation’s largest insurer by revenue earlier this year made a bold announcement to achieve net-zero emissions for companies in its stock and bond portfolios by 2050.

While insurers worldwide, including France’s AXA and Germany’s Allianz, have introduced similar goals for net-zero carbon dioxide emissions at investee companies, Nippon Life is the first major Japanese institutional investor to officially adopt such a policy.

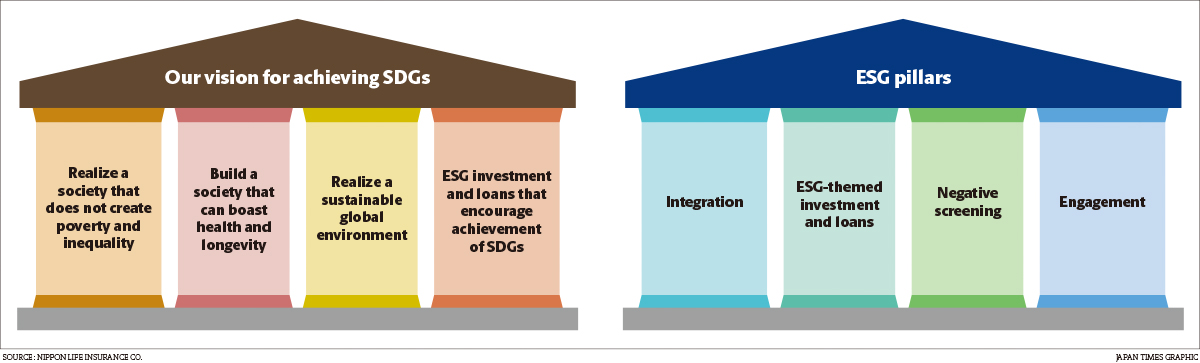

ESG pillars

To push ahead with ESG investment and loan activities, Nippon Life in March established the ESG Investment Strategy Office.

Founded in 1889, the company has been engaging in investment and loans that contribute to social infrastructure, such as railways and waterworks. The company said that the recent move toward focusing on responsible investment is in line with its long-held policy of “co-existence, co-prosperity and mutualism.”

While accelerating moves to strengthen ESG investment and loan activities, the insurer signed the United Nations-supported Principles for Responsible Investment (PRI) in 2017.

PRI, an organization founded in London in 2006 to help investors engage in responsible investment, urges the factors related to ESG be taken into account in investment decisions. The number of asset owners and investment managers that are signatories to the PRI has grown to over 4,000 globally and collectively represents about $100 trillion in assets under management.

In PRI’s annual assessment in 2020, Nippon Life received the highest assessment grade, A+, in the four modules of Strategy and Governance, Listed Equity-Incorporation, Listed Equity-Active Ownership and Property for the second consecutive year.

Nippon Life’s ESG strategy is based on four pillars: integration, engagement, ESG-themed investment and loans, and negative screening.

Under its previous medium-term management plan through 2020, Nippon Life achieved its initial ESG-themed investment and loan target of ¥200 billion in less than a year in 2017, and revised its target upward to ¥700 billion in the following year. As of the end of fiscal 2020 ended in March, accumulated ESG-themed investment and loans had surpassed ¥1 trillion.

Under the current medium-term management plan through 2023, Nippon Life has set a cumulative target of ¥1.5 trillion from fiscal 2017.

As for its negative-screening, Nippon Life has made it clear that it will prohibit investment in and loans to companies that manufacture cluster munitions, biological weapons, landmines or chemical weapons. It also recently announced that it will prohibit new investment in coal-fired power projects in Japan or overseas.

Narrowing the perception gap

“In order to enhance our ESG integration, it is important to create a positive feedback cycle between ESG integration and engagement activities,” Kimura said.

When integrating ESG factors into investment analysis, investors examine ESG factors alongside other valuation drivers, and adjust the forecasted financials (such as revenue and operating costs) of investee companies by calculating the expected impact of ESG factors. Investors gather ESG-relevant information from multiple sources (including company reports and third-party investment research) and identify material factors affecting the investee.

“Among various information sources, engagement through dialogue with investee companies is the most important opportunity to obtain ESG-related information,” Kimura said.

Unlike a company’s financial reporting, ESG data is considered nonfinancial information. It is becoming a crucial component in decisions for investors around the world as it shows a company’s attitude toward the environment, society and governance and is believed to indicate its potential for growth.

“However, there is a perception gap between investors and investee companies with regard to the degree of nonfinancial information disclosure,” Kimura said. According to some survey results, many companies think that they have disclosed enough nonfinancial information, but investors do not think so and demand more.

In order to narrow this perception gap and obtain enough nonfinancial information, engagement activities are very important for investors.

“In addition, we can obtain forward-looking information through dialogue with investee companies,” Kimura said. Investors who use more forward-looking nonfinancial information and more information about internal structures can offer more accurate forecasts. This then raises the effectiveness of ESG integration.

Strength of the group

Kimura pointed out that Nippon Life has a distinct advantage in having Nissay Asset Management Corp. as a subsidiary. NAM joined PRI in 2006 when the organization was founded. It has been actively making investments incorporating ESG ratings for more than a decade.

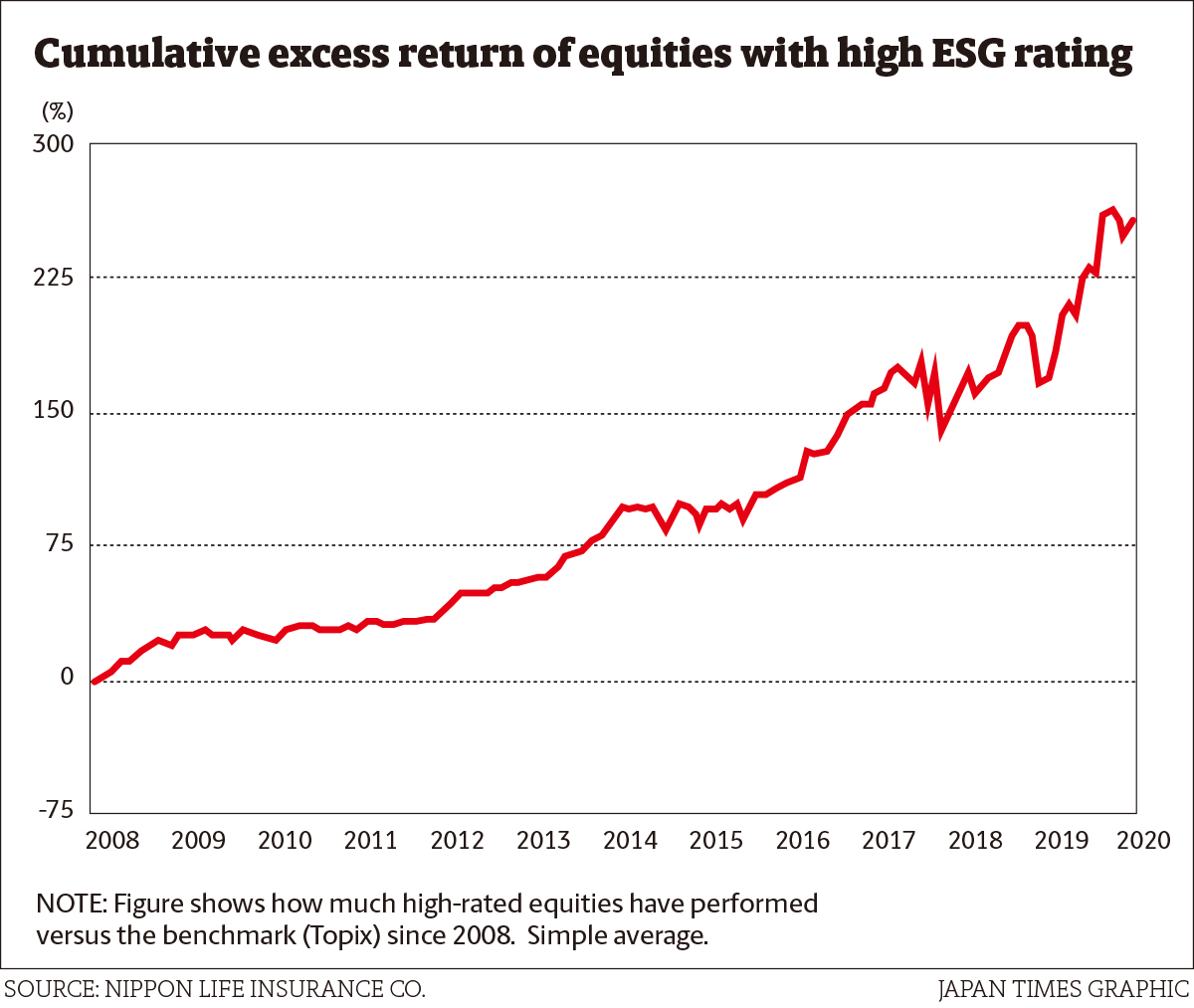

NAM’s ESG ratings are based on various information sources, including dialogue with investee companies (see chart). Average return of equities with high ESG ratings outperform the benchmark (Topix).

“Looking at NAM’s environmental rating, the performance of high-rated equities appears to have improved since the Paris Agreement in 2015,” Kimura said.

“The reality is that ESG scores issued by various rating agencies vary from agency to agency,” he said, adding that it is especially difficult to evaluate ESG’s “social” aspects and assign ratings because the S factor involves human rights, labor issues and other aspects that are difficult to quantify.

“That is why it is important to come up with our own evaluation based on information we gather from various sources, including our own analysts and resources from NAM, ” Kimura said. “We will make investment decisions based on the information overall.”

“The Nippon Life Group’s strength is that it has the functions of both asset owner and asset manager. By fully utilizing the experience and expertise in ESG investment accumulated by NAM, we can enhance responsible investment and contribute to the realization of a sustainable society,’’ he said.

The road to net-zero

As for the target for reaching net-zero greenhouse gas emissions in its portfolio by 2050, Nippon Life aims to achieve its goal through ESG integration and engagement with investees.

Nippon Life holds equity in roughly 1,500 Japanese companies. As of 2019, the volume of carbon dioxide emissions produced in its portfolio came to about 10 million tons per year. Stock prices linked with coal-fired power plants have recently underperformed.

Prime Minister Yoshihide Suga pledged in October that Japan will become carbon neutral by 2050.

“Responding to climate change is no longer a constraint on economic growth,” Suga said. “I declare we will aim to realize a decarbonized society.”

The Ministry of Economy, Trade and Industry also released a road map to achieve decarbonization in December, including the government’s plan to raise offshore wind energy output to 45 million kilowatt-hours by 2040 and increase hydrogen power consumption to 20 million tons by 2050.

The report also designated 14 industries where significant growth and investment are key to achieving net-zero. These are offshore wind, ammonia fuel, hydrogen, nuclear energy, cars, shipping, airlines, semiconductors, logistics, agriculture, carbon recycling, housing, energy recycling and the lifestyles of individual people.

“Of course, it is not possible to achieve carbon neutrality through institutional investors alone. Our role as a “universal owner” is to accelerate the shift toward the net-zero goal pledged by the government,” Kimura said.

If companies fail to reduce carbon dioxide emissions, in the future, they may face high costs in dealing with various environmental regulations or a risk of becoming stranded assets due to environment-related factors. Stranded assets are those that have suffered from devaluations or conversion to liabilities due to various factors, such as a sudden policy shift or changes in market environment.

If the value of such companies drops, then their investors will also suffer.

“That is why we need to achieve the net-zero target. We will try to push the investees to move toward sustainable development goals and improve their enterprise value through constructive dialogue on ESG issues,” he said.

ESG has long way to go

As for the challenges Nippon Life faces in the coming years, the company says its initiative to incorporate ESG factors into all investment processes is still in the early stage. Hence, there is still work to be done to make sure it is an effective means to boost enterprise value and return on investment with a long-term perspective. Kimura pointed out that fully integrating ESG factors into investment process requires trial and error to find a best practice.

When people talk about climate change, they often associate that with corporate risk because decarbonization requires businesses and governments to make investments. But Kimura says that is only one side of the coin.

“People talk about transitional risks with regard to climate change, but there should also be opportunities. Because huge investments will be made, such as in new technologies to reduce carbon emissions, it is important to figure out where the money will flow to,” he said. “That’s an opportunity for making returns. We need to watch out for such chances.”

To fulfill its coverage obligations to policyholders even in a harsh environment with ultralow interest rates, Nippon Life aims to ensure long-term stable investment returns. “To this end, we are working to bolster its investment and loans in new and growing fields, including ESG investment and loans,” Kimura said.

Kimura was the director-general of the Bank of Japan’s Payment and Settlement Systems Department until last year. He says his work related to sustainable finance at Nippon Life is similar to the macroprudential policies he was engaged in at the BOJ.

Macroprudential policies are financial policies aimed at ensuring the stability of the financial system as a whole to prevent substantial disruptions in credit and other key financial services necessary for stable economic growth.

“It’s similar to what I was doing at the BOJ in terms of avoiding systemic risks. Climate change is a kind of systemic risk from ‘externalities,’ ” Kimura said.

To avoid systemic risks in the financial sector, he said it is important to incorporate a macroprudential perspective in promoting a sustainable financial system.

“The Nippon Life Insurance group has actively been involved in various initiatives in Japan to improve the environment for sustainable finance,” Kimura said, referring to government bodies working on such topics as social bonds, transition finance and sustainable finance. “We hope to proactively cooperate with communities not just in Japan, but also overseas, in this area to further promote ESG investment.”