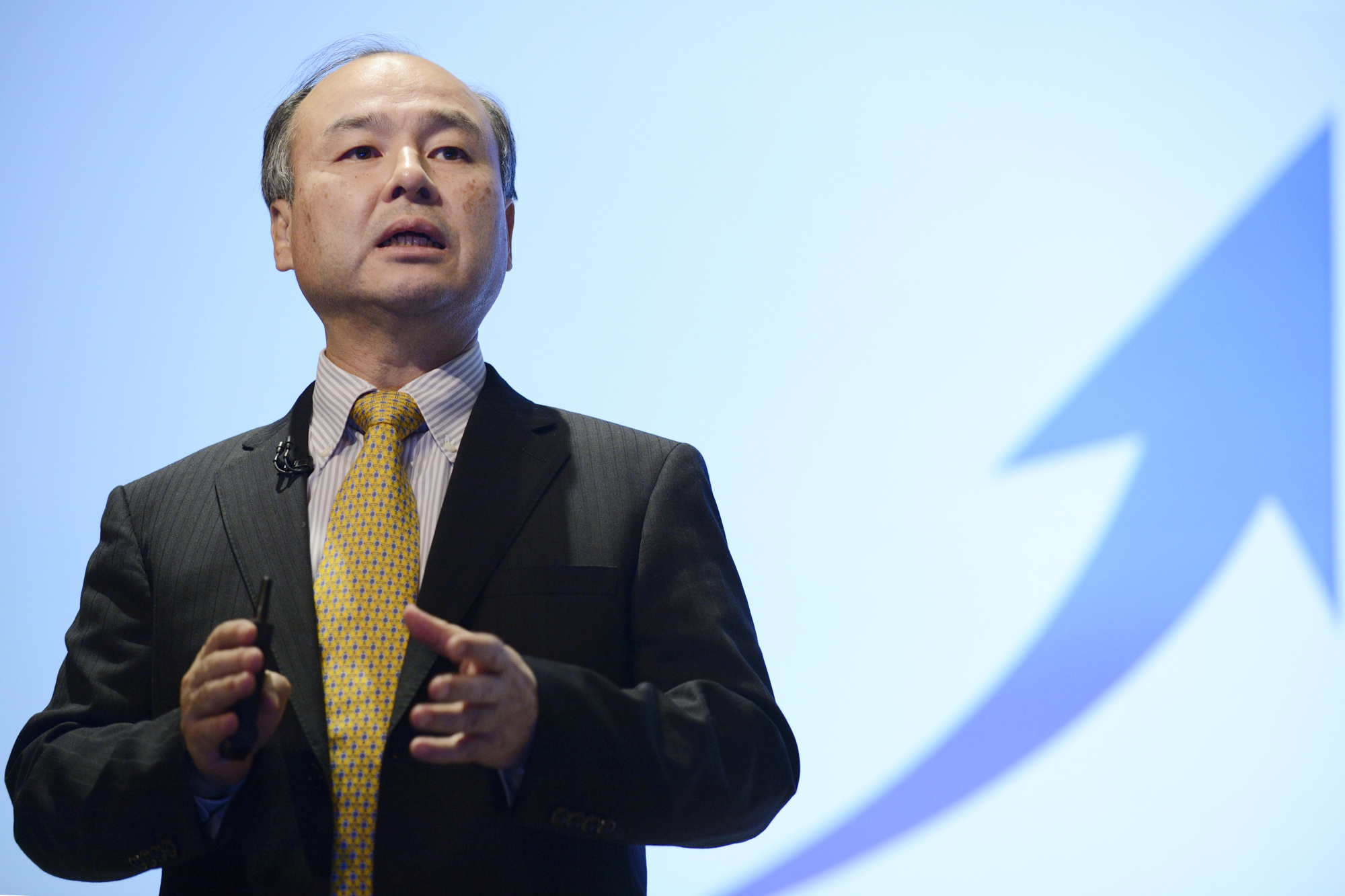

SoftBank Group Corp. has secured the first capital commitment to a $100 billion fund organized with Saudi Arabia and Abu Dhabi that would eventually put its founder Masayoshi Son in charge of one of technology's biggest investment vehicles.

The telecom conglomerate is investing $28 billion and has agreements with Saudi Arabia's Public Investment Fund, Abu Dhabi's Mubadala Investment Co. and Apple Inc. With more than $93 billion committed, the fund — which includes Qualcomm Inc., Foxconn Technology Group and Sharp Corp. — aims to reach $100 billion within six months, SoftBank said in a statement Saturday. Mubadala committed $15 billion, according to a separate statement.

The Vision Fund will seek long-term investments in businesses aimed at innovation. SoftBank has relied on borrowing and earnings from its domestic telecom operations to pay for investments in startups in India, the United States and China while dealing with losses at U.S. subsidiary Sprint Corp. By tapping outside investors, billionaire Son will be able to cut more ambitious deals than he could on his own.

With your current subscription plan you can comment on stories. However, before writing your first comment, please create a display name in the Profile section of your subscriber account page.